Variety of Fund getting Investment a little House

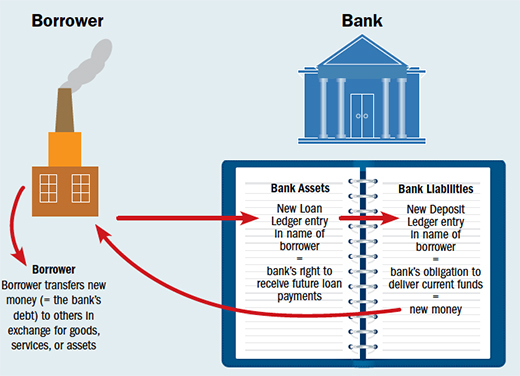

When it comes time to payday loan finance their smaller home you can find a number of different type of loans readily available: signature loans, Rv money, manufacturer money, and build money. Unsecured loans typically have lower interest levels than handmade cards however, wanted a good credit score score; Camper loans are specially designed for leisure auto for example RVs and you may take a trip trailers; brand fund make it customers to purchase right from producers during the deal prices; and you will build funds provide financing during the strengthening procedure to ensure owners don’t have to pay initial costs out-of-wallet. Every type out of financing has its own pros and cons so make sure to research thoroughly before deciding which is actually good for you.

To close out, financing a small home will be difficult but there are some different choices offered according to what type of budget and lives you are interested in. Shop around ahead and that means you learn all costs associated with to buy and you may keeping a tiny house prior to committing yourself economically.

Benefits of Staying in a tiny Home

Residing a tiny domestic has-been increasingly popular along side earlier very long time. The small dimensions and you may freedom of these residential property render many book masters one to complete-measurements of home do not give. Within this point, we will discuss a number of the advantages of surviving in a little family.

Mobile Lives and you may Independence

One of several explanations people want to live in an effective small residence is because even offers all of them the fresh new independence to move as much as because they excite. Such residential property are a lot smaller compared to antique home, so they are able getting transported with ease with just a trailer or truck. This allows individuals to take their residence with these people no matter where they wade, permitting these to speak about different parts of the country and you will feel the newest cities without worrying throughout the seeking somewhere to keep.

A separate advantageous asset of having a mobile lifestyle is you dont need to worry about being fastened right down to you to area. If you get fed up with surviving in one put, you can simply finish off the lightweight family and you can move somewhere more without worrying about attempting to sell your house otherwise interested in an alternative destination to live.

You simply cannot Park it Everywhere

Even in the event residing a small domestic even offers benefits, there are also certain drawbacks that can come with it. One to disadvantage is that you cannot playground they everywhere you prefer. Because these property are so small, they have to be put on land that is zoned for amusement car (RVs). Because of this if you would like live-in your own little household complete-day, you should find homes that’s zoned to possess RVs or get a hold of a keen Camper park that will enable one playground your home truth be told there much time-title.

Building Equity

The very last advantageous asset of staying in a small house is one it can help you build guarantee throughout the years. In lieu of antique domiciles which require large down costs and enormous month-to-month mortgage repayments, lightweight properties generally want way less upfront can cost you and you may faster monthly costs. Thus more income might be stored per month instead of being place to the repaying financial obligation. Through the years, this can help build-up guarantee that may then be used to many other financial investments otherwise orders including buying extra land or upgrading your own smaller family.

A small house is an effective way to live a conservative life and you can spend less. Yet not, investment a tiny house means careful consideration. There are many different mortgage designs available that will help you finance your ideal little home.

Consumer loan

A personal loan the most common an easy way to money a small home. Unsecured loans are typically unsecured loans with fixed rates and you may repayment words. They will not want equity, which means you don’t have to set-up any property in order to safe the borrowed funds. Signature loans are usually simpler to rating than many other type of investment and will be used for objective, also capital a small house.

Deja una respuesta