Getting an informed Mortgage to suit your St. George Household

When it comes to to acquire a property, the majority of us will require home financing of some type. If you do not thinking about buying a property with all of cash, capital ‘s the second choice. Yet not, only a few funding is generated equal. There are a lot of mortgage options, loans, software, home buying guidelines software, and you may mortgage brokers to pick from. Just how is actually a purchaser to decide? In terms of finding the best financial when you look at the St. George Utah, you do must do some look however, i would ike to make it easier to organize one to research so that you discover what to come across and you will what issues to ask. Manufacturers also want to learn why kind of financing you’re going to get from the a property offer it is therefore crucial that you be aware of the distinction.

First-day homebuyers

If you have never bought a house prior to, you’re probably have to home financing. Perhaps you have saved any money getting an advance payment? This isn’t to say that you need to have a straight down payment to buy property nonetheless it however facilitate.

You will find USDA lenders that provide a zero-down financial choice, but the interest rates can be a little section higher. The second smartest thing to have first-time homeowners is usually the new FHA financing. This really is a great 3.5% downpayment so if you done a small amount of saving, it is your best option. A lot of times downpayment advice apps or closing cost guidance programs can help with the other aside-of-pouch will set you back that come with to order a property.

An enthusiastic FHA home loan is actually an effective federally backed home loan that generally appear having home loan insurance rates. As you have set below the recommended ten% down on property, lenders and banks think that there can be even more exposure inside. For many who default on mortgage, they would must turn around and resell the house or property, typically losing money with the purchases and you will deals. Financial insurance supplies the lender a small amount of a shield if that was basically happening, so they really never beat too much money to your sale from the house.

FHA mortgages manage wanted a beneficial step three.5% down-payment option, however, there are extra programs which can give at the least a great .5% assistance or you can even have more cash gifted for you off family unit members otherwise family.

Second-day customers

For those who already own property and you are clearly thinking about promoting your home to shop for a differnt one, you probably have a very good chunk regarding collateral to place off towards second domestic. Should this be the situation, you’ll want to go with a traditional mortgage. This is exactly usually about a beneficial 10% to 20% down payment, that can lower your rate of interest and you may start solutions for a whole lot more mortgage options.

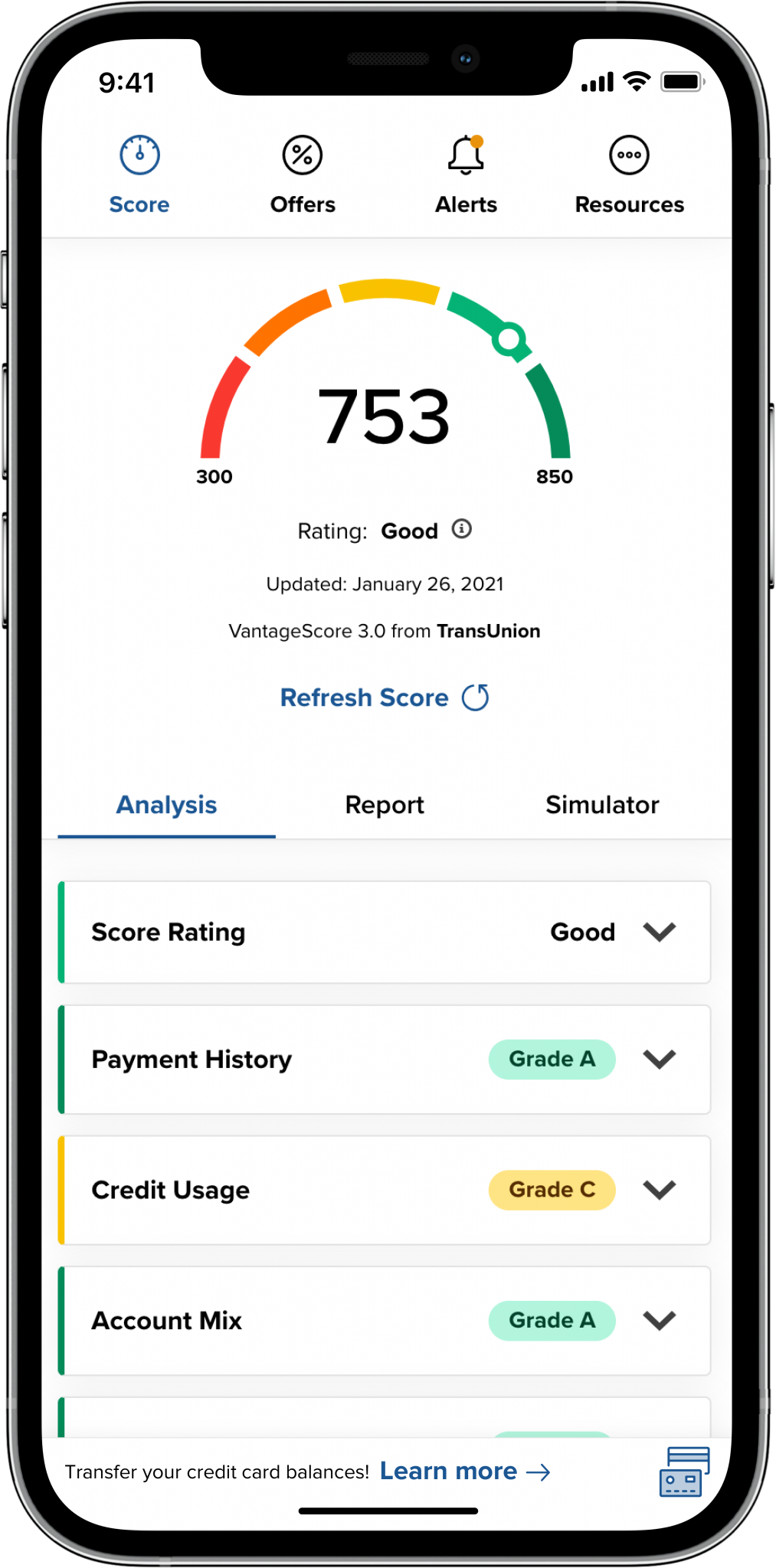

Irrespective of and therefore home loan you choose, credit rating, credit history, debt-to-income ratio, earnings, assets, and you will debts will most of the enjoy a factor in your interest rate and you can terms of the loan. You will be thanks for visiting like good 10-seasons, 15-year, or 29-seasons mortgage, and you will interest rates vary depending on every one. You’re likely to score a lower interest with a lesser identity, however your costs might possibly be higher. However, you are able to pay-off your house quicker and acquire equity faster.

Lender otherwise financial administrator?

Next comes the selection into the where you are going to get this mortgage. You might favor their lender otherwise credit union, that may usually become reduced in costs but more limited into the options. Financial institutions and you may borrowing unions normally match their particular money, that have set interest levels and you may conditions.

Going for home financing officer or mortgage advisor function you’ve got access to a huge selection of additional banking institutions, loan providers, and you will software available. The latest initial price of using a mortgage administrator is a little bit more than a lender, however, this is basically the 1st fee as opposed to a lot of time-name.

Home financing Ivalee loans administrator does produce a much better bargain finally, helping you save thousands of dollars along side longevity of the borrowed funds. I always strongly recommend going with an exclusive home loan administrator to track down an educated home loan because they can seek an informed choice, software, and you will conditions per private consumer.

Folks are other regarding trying to get a mortgage. Every person’s earnings, costs, property, liabilities, and you can credit rating are very different greatly, very mortgage officials examine these into an incident-by-circumstances base.

Deja una respuesta