Facts to consider Whenever Investment Screen Replacement

Window replacement for would be expensive but resource is oftentimes available. Home owners will get lowest-desire fee preparations from screen businesses inside their urban area.

Screen replacement for is costly, but the return on your investment in the energy savings and you will an enthusiastic upsurge in domestic well worth covers alone throughout the years.

This post also offers a guide on comparing funding solutions out of screen companies and you can 3rd-group lenders. Uncover what you may anticipate regarding replacement for screen people which have commission plans towards you or consult a bid lower than.

What will an alternative screen cost and certainly will We spend the money for commission? There are numerous options for opting for how exactly to loans the replacement for windows. Essentially, you ought to build the best selection you to saves you probably the most currency and will be offering a simple application techniques.

Family Guarantee Credit line (HELOC)

These types of capital was a good rotating credit number where you reside utilized since the guarantee. The amount which you have already reduced toward prominent regarding the financial will give you equity that you could borrow on.

Youre recognized for a credit limit, and as you have to pay into harmony, the amount of available borrowing is actually restored. The fresh mark months about this types of credit line is normally a decade with full installment during the 2 decades.

An effective HELOC should be a selection for those individuals property owners one to keeps numerous home improvement projects and don’t want to re-apply having fund with every the project.

House Collateral Mortgage

These money is much like an excellent HELOC since your residence is used given that security. You are and additionally tapping into the latest guarantee you may have compiled courtesy money on principal of your own mortgage loan.

The real difference is that you discover a lump sum and you may must pay back the loan at a fixed price into the lifestyle of financing.

That have both an effective HELOC and you may domestic equity mortgage there is certainly exposure inside it. You reside physically associated with the credit, whenever your forfeit, you could reduce the house.

Home loan Refinance

For those who refinance your existing financial, this might save you thousands that would be placed on funding your screen replacement opportunity.

Refinancing also can put you inside a better status to safer an excellent HELOC or home equity loan because the the brand new home mortgage could be below the initial.

Unsecured loans

While a different citizen and do not have sufficient equity in your home to consider a few of the prior options, an unsecured loan can be your own answer.

Signature loans is attractive when you yourself have a long-position reference to the bank otherwise borrowing from the bank commitment. Brand new prices trust their creditworthiness and get a smaller benefits go out, constantly a couple-five years.

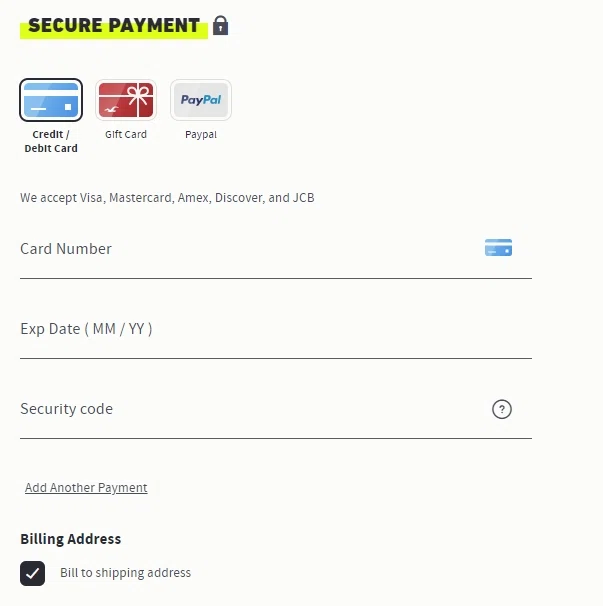

Charge card Loans

Keep in mind that interest rates towards mastercard sales are constantly a lot higher than fund. If you contemplate using a charge card, see special offers that have 0% rates of interest or shop for a lower speed for brand new consumers.

Do Do it yourself Enterprises Render Financial support getting Screen Replacement?

If you view web site are looking to keep your window replacement investment and resource as one in one place, of numerous home improvement businesses bring payment arrangements.

- Interest

- Loan amount diversity

- Installment go out

Significant Do it yourself Merchandising Businesses

These do it yourself company is element of an enormous strings which provides construction and you will financing. Will special promotion now offers having down interest levels are given while the the windows replacement organization brings in money from just your installations however, interest money as well.

Whenever choosing to financing with a major do it yourself retailer, it is essential to check around exactly as you might with lending organizations. Please note, the latest lower than costs and promotions are all susceptible to alter. It is to have informational intentions simply.

Deja una respuesta