Simple tips to make an application for a good HELOC which have reasonable borrowing

In the event your credit history are borderline anywhere between reasonable and you can a great selections, it could be worth every penny adjust your own get before you apply having an effective HELOC.

Paying off revolving financial obligation, deleting problems regarding credit reports, and you may to avoid the newest credit programs will help. Also a 20 so you’re able to 31-section increase could meet the requirements you having a far greater speed.

But when you you would like HELOC fund seemingly soon, implement along with your newest reasonable credit history. You could potentially probably refinance later on within a lower life expectancy speed in the event the credit enhances.

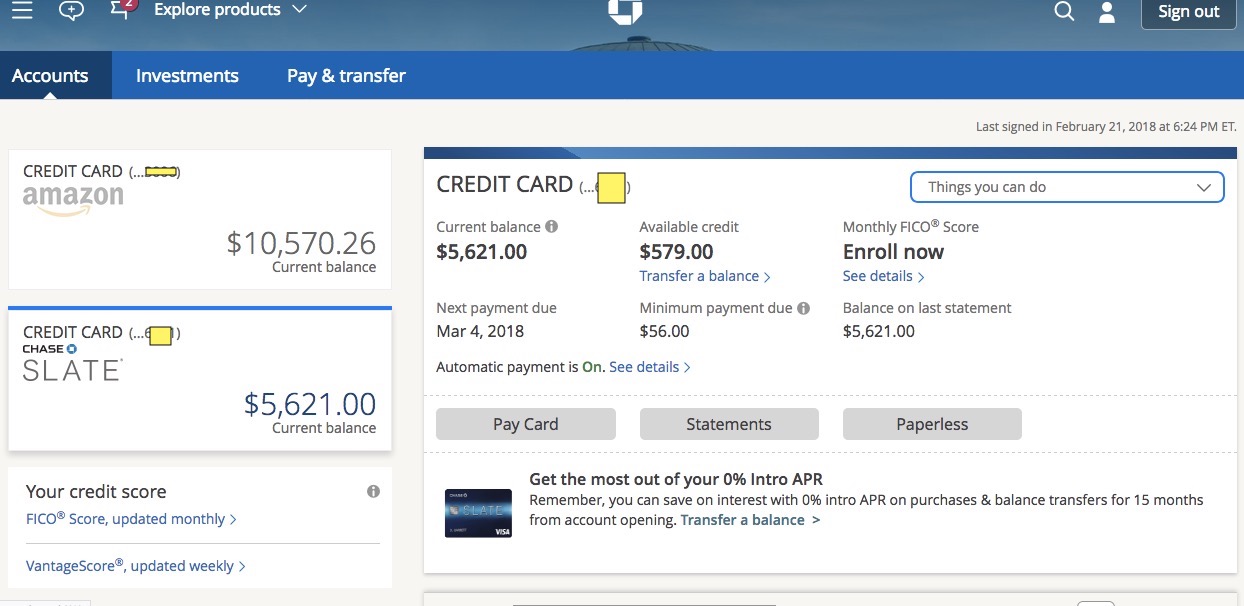

An instant way to improve credit history is by growing their credit limit or paying down loans. You should never use more than 31% of the total credit limit.

- Prequalify having several loan providers to see estimated rates and terms in place of a painful borrowing from the bank pull. The 3 reasonable-borrowing HELOC lenders over are a place to begin your own search.

- Collect most of the necessary paperwork, together with W-2s, shell out stubs, financial comments, taxation statements, and you will a price of the residence’s current well worth. The lending company should make sure your earnings and household equity number.

- Find the lender to the finest bring for your borrowing profile and apply. This will end up in a challenging credit score assessment.

- The lending company have a tendency to acquisition a proper family assessment to verify the fresh new worth and you can equity condition. Yet, anticipate to promote any additional records your own financial desires.

- In the event the recognized, this new closure techniques starts, where you are able to remark and you will indication the last charge, rate of interest, repayment plan, or other judge disclosures.

The full application to help you approval process can take a few so you can half a dozen months if the what you goes efficiently. Underwriting and appraisal minutes may differ for how hectic brand new bank is actually.

Having ayour documents able upfront will assist expedite the process. The lending company North Carolina personal loans will even show whether or not it need people a lot more records.

What is sensed fair borrowing to possess good HELOC software?

Based on FICO, reasonable borrowing often falls within 580 to 669. Your credit rating matters whenever trying to get an excellent HELOC because is essential throughout the lender’s choice-and then make processes. You might nevertheless be eligible for a great HELOC with a good borrowing rating, however the rates of interest would-be large.

Exactly how much equity manage I need in my home to help you qualify having an excellent HELOC?

Of a lot lenders require residents getting at the least 15% house collateral to qualify for an effective HELOC. It means the control share on your assets. The newest commission needed can vary centered on your credit score, income, or any other monetary situations.

Must i however rating good HELOC with high personal debt-to-money ratio?

While you are a leading financial obligation-to-money proportion causes it to be much harder to help you be eligible for a great HELOC, it isn’t impossible. Particular lenders convey more flexible requirements and so are ready to thought individuals which have highest rates, particularly if he has strong borrowing from the bank and big domestic collateral.

Which are the normal costs associated with the obtaining a HELOC?

When making an application for a great HELOC, you could encounter a loan application fee, assessment fee, name search percentage, and you can closing costs. This type of will cost you accumulates, it is therefore crucial to grounds them to your choice when you compare HELOC alternatives.

How does an excellent HELOC apply to my credit history?

A beneficial HELOC can affect your credit score in many ways. Initially, obtaining an effective HELOC could potentially cause a little drop in your rating as a result of the lender’s difficult query. Through the years, responsible explore and on-time costs can also be build your credit score and you can improve your rating.

Must i re-finance my personal HELOC towards a predetermined-price loan?

Yes, one may refinance your HELOC to your a predetermined-rates financing. The process pertains to replacement the variable-speed HELOC with a new loan having a fixed interest. This tactic may bring predictability towards repayments but could results in conclusion will cost you.

Deja una respuesta