What are the advantages of Virtual assistant funds than the Conventional finance?

When you need purchasing otherwise re-finance a house, Va loans are often a far greater alternatives than simply Old-fashioned fund. That is because Virtual assistant fund features aggressive interest rates, lower down repayments, straight down lowest credit scores, minimizing financial insurance premiums than the Conventional loans.

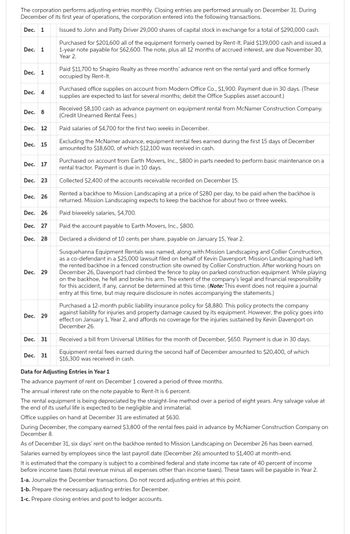

Just be a seasoned, active-responsibility military personnel, or a thriving mate so you’re able to be eligible for a great Va financing. You are generally simply for buying simply primary home having Virtual assistant finance. So there is actually times when a traditional mortgage renders way more economic experience than simply good Virtual assistant financing. Check out our review table:

Which are the advantages of Va fund versus Conventional loans?

You might tend to get an aggressive interest rate with a reduced credit history of the opting for an excellent Va mortgage rather than a traditional financing. It’s also usually you’ll to shop for a home instead a down commission. There are not any month-to-month home loan insurance rates money. And you will Va streamline refinancing can help you reduce your rate of interest with less documentation and you can a faster closing.

Which are the advantages of Antique financing instead of Virtual assistant loans?

Virtual assistant loan places Sacred Heart University money is actually simply for Veterans, active-obligations army staff, and you can thriving partners which meet with the qualifications standards. Antique funds do not have these types of qualification conditions.

You could potentially just purchase or refinance much of your residence having an effective Va financing. Which have a normal mortgage, you could potentially finance no. 1 land, vacation property, local rental characteristics, and you can funding services. Youre and generally limited to with you to Va financing on a period of time whilst you have multiple Traditional mortgage at a time.

Virtual assistant fund are an initial, one-go out financing fee that’s owed within closing or shall be financed into your financial number. The Virtual assistant funding percentage is a kind of mortgage insurance policies. The price assists include the fresh new Virtual assistant loan system when borrowers standard. Particular handicapped veterans and you can thriving partners was excused regarding expenses so it percentage.

Antique loans haven’t any initial costs for instance the money fee. not, Traditional fund usually require monthly payments to own private financial insurance (PMI). The total cost of this type of PMI costs over the longevity of the loan might be higher than the price of your capital payment.

Let’s view samples of the cost of the Va investment percentage as opposed to the price of private financial insurance policies. Assume that you are to find property which have a beneficial 10% downpayment and you will a beneficial $300,000 home loan.

In this example, might pay a funding commission of 1.25% of one’s amount borrowed otherwise $step 3,750 if you purchase our home with a great Va mortgage.

Freddie Mac prices that you may pay anywhere between $31 and you can $70 four weeks in the PMI for each $100,000 you obtain which have a traditional loan. In this example, it means you could potentially spend between $90 and you may $210 monthly, or ranging from $step 1,080 and you may $dos,520 a-year, to own private home loan insurance. Consider this table:

A conventional mortgage you’ll save you some cash on the financial insurance rates will set you back if you possibly could terminate their PMI over the years otherwise it may cost you even more. In this analogy, choosing to afford the capital percentage rather than PMI could make way more monetary feel.

Now, guess youre to buy property that have good 20% down payment and good $3 hundred,000 mortgage. While and work out an effective 20% down-payment, you would not have to pay having individual home loan insurance rates. Within this analogy, choosing a conventional financing to eliminate make payment on resource fee can get generate significantly more experience.

You’ll also be interested in the expense of capital fee as opposed to personal financial insurance once you refinance your property. not, once you re-finance your property using an excellent Virtual assistant improve refinance, your financing percentage is only 0.5% of your own loan amount otherwise $step 1,five-hundred once you re-finance a good $300,000 financial.

Look at all of the will cost you before making the decision

Make sure you look at the rate of interest, month-to-month desire money, settlement costs, or other fine print before choosing anywhere between a great Virtual assistant and Old-fashioned loan. Mortgage insurance costs try a significant idea, but they are maybe not the only real of these. In addition to, keep in mind you will need to see all of our borrowing, money, and you will financial criteria to acquire acknowledged for Virtual assistant and Conventional finance.

Versatility Mortgage is not an economic coach. The newest information detail by detail significantly more than are to own informative intentions merely, commonly meant due to the fact financial support otherwise economic advice, and cannot getting construed as a result. Consult a financial advisor prior to very important private financial conclusion.

Deja una respuesta