What is the difference between a house guarantee mortgage and property guarantee personal line of credit?

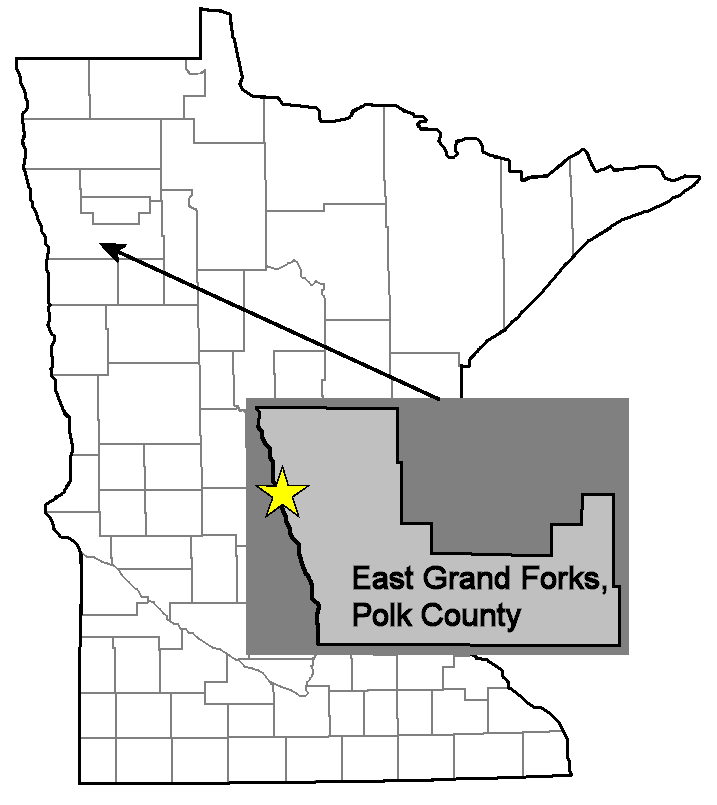

Wouldn’t it be great if you had a gold mine that you could potentially tap into after you required money? If you’ve owned your residence for some time, you happen to be sitting into the a gold mine and never also comprehend it. Experiencing household guarantee loans Brookwood AL will be a terrific way to accessibility money in the rates which can be a lot better than simply credit cards.

A guide to domestic guarantee credit

The newest equity of your property is really what its already value (ount you owe on the mortgage, which is sometimes called their first mortgage. Equity is made when the property value your property expands and you may since you ount you owe through your mortgage payments. Just how far equity have you got?

Can you imagine the market worth of your home is $100,000, therefore owe $55,000 on your first-mortgage. Well-done! You really have security in your home really worth $forty five,000.

So does that mean the complete $forty five,000 can be found so you can acquire due to a home collateral financing or personal line of credit? Not likely, since the majority lenders will let you use around 85% so you can 90% of most recent property value your property. To possess a loan provider that an 85% limitation, you would certainly be able to obtain $30,000 on top of your residence loan. To you mathematics partners, here is the formula: ($100,000 x 85%) without $55,000.

Two types of loans and lots of common provides

There’s two an easy way to borrow against the fresh equity on your house. A house guarantee loan and you will property security personal line of credit (HELOC). Exactly what do he has got in common?

This new recognition techniques both for sorts of domestic equity borrowing from the bank is equivalent. The lending company can look at the credit score and total loans-to-money proportion to be certain you aren’t borrowing more than your are able to afford. You’ll have to fill out papers, in addition to bank may rating an assessment of your home to make sure the market price is right. And you will be expected to pay charges to try to get and you will procedure the mortgage.

Whenever a house guarantee financing otherwise HELOC are awarded it gets an effective 2nd mortgage plus home is pledged just like the collateral. It indicates for folks who avoid and also make costs, the financial institution can be foreclose at your residence.

Desire you pay on a home security financing or HELOC is end up being tax-deductible for many who itemize write-offs and the money you acquire is used to acquire, make otherwise boost the house that you use since collateral for the mortgage.

- Once you receives a commission from the loan

- Exactly how costs was structured

- Just how rates have decided

Distinction #1: Once you get paid.

Having a property guarantee loan, you receive currency initial. If you would like obtain $twenty-five,000 to solve your house, such as for example, the lending company will issue payment to the complete $twenty five,000 if domestic guarantee financing was given.

A HELOC is an approved amount that the bank have a tendency to help you borrow secured on the latest equity of your home. If you are not sure the amount of money you will need otherwise when, you can use monitors or an installment cards that may draw money from readily available credit line loans.

Huge difference #2: How money was arranged.

Money to your a home security mortgage are like very first home loan. You are considering a schedule out-of month-to-month attract and dominating costs while making in accordance with the term of the mortgage. Very home guarantee lines are set to have a term ranging from 5 and you will twenty years.

HELOC money are organized a few indicates. The initial lets you build desire-simply money throughout a flat time for you draw or borrow funds at stake away from borrowing from the bank. Next means prominent and notice payments in draw months. Both in ones points, you’ll be needed to generate appeal and you can principal repayments to spend from the personal line of credit adopting the draw period closes.

Distinction #3: How rates have decided.

House equity funds normally have a fixed interest that doesn’t change-over the term of one’s financing. These types of rates are a bit greater than adjustable-rate financing.

Most HELOC loans features a varying rate of interest that is adjusted centered on alterations in prominent monetary benchple. With HELOC financing, you might transfer the pace off varying to help you fixed.

Thus what’s the best choice?

Opting for anywhere between a predetermined speed, set number family guarantee loan and you can a varying speed, unlock line of credit really depends on your situation.

If you wish to borrow a predetermined amount and do not pick the need to obtain once again for a time, a home guarantee mortgage provides you with an appartment agenda to pay right back the loan.

However, if additionally, you have a consistent need to borrow smaller amounts and you will shell out those people straight back quickly, the flexibility out of a good HELOC was most readily useful.

Anyway, making use of the newest guarantee of your home should be an excellent treatment for finance home improvements, repay an consolidate highest focus personal credit card debt, or make you comfort understanding you have access to dollars at sensible prices to possess issues.

Deja una respuesta