What’s private home loan insurance (as well as how do i need to avoid it)?

When it comes to to buy property, the traditional faith is actually you to definitely a good 20% down-payment is actually expected. Yet not, preserving upwards this much is going to be difficult, particularly for basic-go out homebuyers otherwise some one seeking get into the present housing market easily. That’s where individual mortgage insurance (PMI) comes into play, providing an alternative to possess individuals that simply don’t possess a big down fee.

What is private mortgage insurance coverage, and why must i care?

While like any Americans, you truly have to borrow funds purchasing a house. And if you are making a down-payment out of less than 20%, the lending company needs to manage by itself. Private mortgage insurance policies (PMI) try insurance coverage one benefits the lending company from the securing them however, if your standard on your upcoming mortgage repayments. But how might you, the target homebuyer, make the most of trying out personal mortgage insurance?

If you are paying a monthly PMI advanced, you could safe home financing and you can go into the housing marketplace at some point than just should you have to go to to store upwards getting a beneficial complete 20% deposit. In addition makes it possible for you to definitely start building house collateral and you can enjoy the advantages of homeownership quickly.

Finding out how PMI performs

Whenever you are PMI lets customers to go into the brand new housing industry which have a great lower down commission, there’s a disadvantage. For a while, you will have a little highest month-to-month mortgage payments while the you will end up borrowing from the bank significantly more initial. However, usually, PMI does not stay-in impression for the entire mortgage label. Once your equity yourself is at 20%, you can request to help you cancel PMI.

Before you adore a house or decide on a mortgage, you should speak with online payday advance Delaware the loan officer about the PMI can cost you according to your specific financial situation. It’s incredibly important to know elements you to definitely decide how much it is possible to pay money for PMI.

Products affecting PMI will cost you

- Kind of residence:Whether you’re to purchase just one-home, condo otherwise townhouse affects your own PMI rates.

- Sorts of mortgage: Conventional loans and you can authorities-supported finance has some other PMI standards.

- Financing term:Are you a 15-year otherwise 31-12 months home loan?

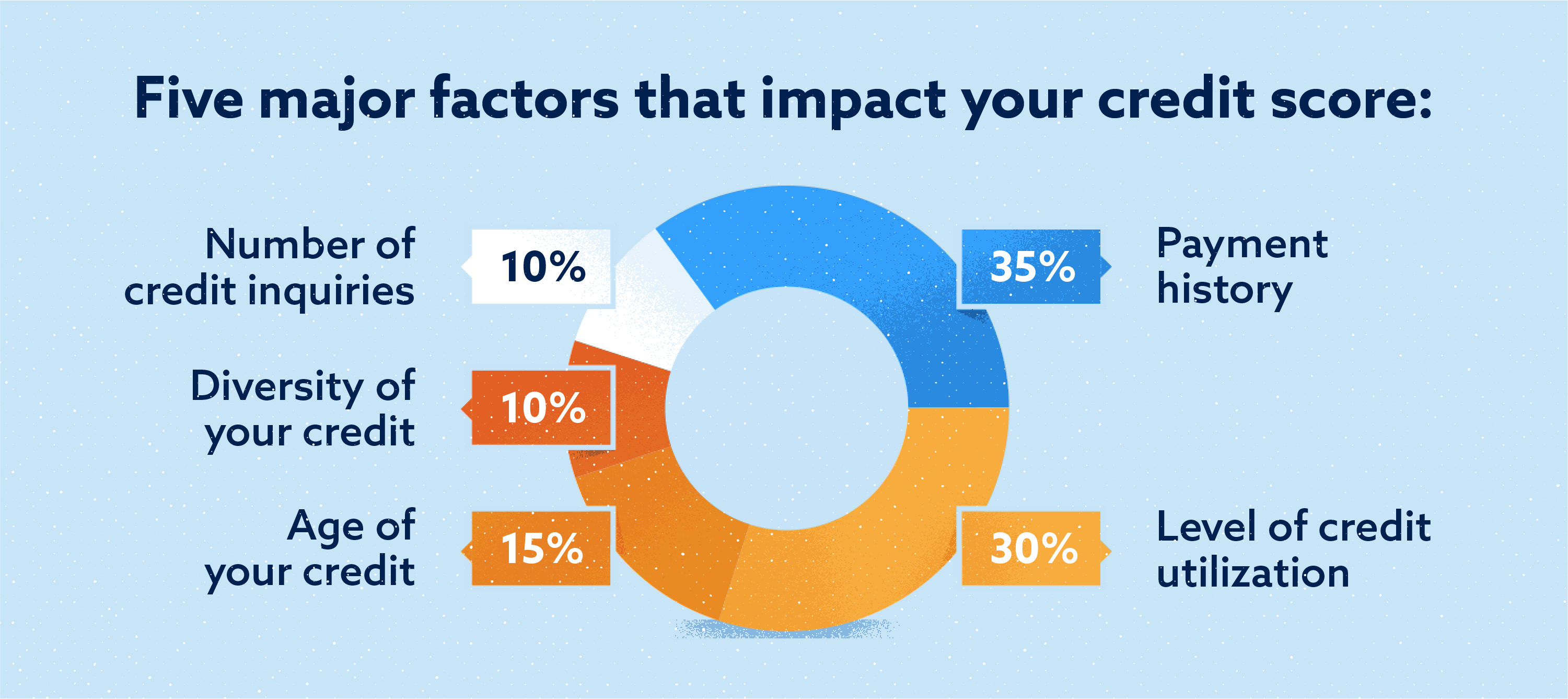

- Credit score: A high credit history normally results in all the way down PMI premium.

- Interest: It influences your overall mortgage repayment, along with PMI premium.

- Down payment number: The more you place off initially, the low the PMI.

- Loan-to-well worth (LTV) ratio: A lesser LTV fundamentally results in faster PMI money.

- PMI sort of:Different varieties of PMI provides varying will set you back and you can structures.

Your own PMI percentage is actually determined considering numerous things. Typically, PMI costs between 0.5% to help you 2% of your loan amount per year. Eg, if you acquire $450,000, at a good PMI rates of 1%, might pay $4,five-hundred a-year or around $375 monthly. Bear in mind this is an offer, as well as your real rates is dependent on the loan amount, PMI speed and other facts. To track down a clearer notion of your PMI rates, explore our financial calculator observe exactly how some other loan number, interest levels and you can PMI pricing might connect with your own monthly payments.

Well-known form of PMI

Discover different types of private home loan insurance rates. Selecting the most appropriate choice for you hinges on yours goals and home-to find condition.

- Borrower-paid down mortgage insurance (BPMI): You pay which advanced within your month-to-month mortgage repayment. After you reach 20% security, you can consult so you can cancel BPMI.

Could you avoid purchasing PMI?

How you can end PMI is always to create a great 20% downpayment. Although not, that is not constantly possible. Specific regulators-backed financing, such as FHA loans and you may Virtual assistant finance, have mainly based-in PMI or insurance fees. For many who choose financing which have PMI, find that that have cancellable conditions, so you can cure PMI when your equity are at 20%.

To eliminate PMI, you’ll need to demand it written down, along with your bank will get qualifications conditions, such as although not simply for:

You would like More and more PMI?

Personal mortgage insurance helps homebuyers secure financing having a smaller down payment, however it is important to see the brands, can cost you and solutions. When you’re ready to find out about PMI or speak about your financial options, get in touch with a movement Home loan manager now.

Note: Movement Mortgage is not affiliated, endorsed, otherwise backed by Department out of Experts Items or Federal Housing Management and other bodies service.

Deja una respuesta