Why does the USDA Financial Processes Really works?

In this article

- USDA Financial Qualifications

- USDA Financial Processes

- USDA Mortgage Acceptance

We have been these are USDA lenders much to your Moreira Group Weblog lately. They are either skipped of the home buyers-plus specific lenders-given that a beneficial choice. Provided the customer and the household meet the requirements, the latest fund should be granted with doing 100% financial support (zero deposit). In addition, personal mortgage insurance coverage (PMI) is reduced and you will interest rates are usually most readily useful than the antique funds or any other basic-day consumer apps such as for instance FHA fund and you may Va financing.

Truth be told, bringing good USDA loan is like delivering all other mortgage loan. The process is simply the exact same. The borrowed funds unit by itself only has its own legislation and needs.

USDA Home loan Qualification

USDA finance is backed by the usa Department out of Agriculture (USDA) and generally are built to give monetary development in much more outlying components. This is exactly why the new qualification of the home is just as important once the debtor. Brand new USDA also offers a recent eligibility chart you can attempt to find out if the town youre to buy in the qualifies. It nonetheless does include specific suburban locations that may have grown as the history big date they upgraded the chart. You are astonished at just how many towns and cities meet the criteria!

The house being ordered with a USDA financing must end up being put as your primary residence so you’re able to meet the get a personal loan with 600 credit score requirements. It can’t be a vacation house or money spent.

Incase our home is actually an eligible location, attempt to meet the requirements because the a borrower. Discover earnings limitations (along with according to your location to acquire) and other limitations. Such financing are reserved to possess lower-income home buyers which might not if you don’t have the ability to afford a home.

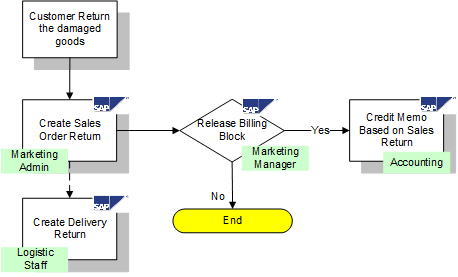

USDA Financial Processes

Outside the certification criteria, here is a simple overview of the newest USDA financing process you can expect with most mortgage lenders:

- Application-Fill in your loan app to an effective USDA-approved lender. Only a few lenders try authorized so you’re able to point USDA funds.

- Financial Paperwork-Provide the financial with requested economic comments and records in order to confirm a position, income, credit score, an such like.

- Pre-Approval-The lender tend to comment all of your advice and you may, for people who qualify, provides you with a home loan pre-acceptance page. This action takes a few days or so long as per week, however it is a significant action to ensure you meet the requirements and you may also to reveal how much cash home you really can afford.

- Domestic Look-Now, you can begin your home look from inside the good USDA-qualified area and begin while making also provides.

- Appraisal-After you’ve a deal acknowledged and commercially begin new closure procedure, the lender usually acquisition a home appraisal to search for the newest fair-market price of the home. They actually do so it to be sure the house is definitely worth the level of the borrowed funds are granted. If not, they are certainly not happy to make risk.

- USDA Acceptance-The financial institution will even send-off the mortgage document on state’s USDA work environment, where it will need last recognition in the USDA. This is another type of process that can take a short time otherwise duration 2-3 weeks depending on some things.

USDA Financial Approval

That important action to notice above was #6. This is actually the one point in which a beneficial USDA financing will disagree than almost every other type of mortgages. It is an extra step where in actuality the mortgage document is distributed toward state’s USDA office to have review and latest recognition. While the property customer seeking to a beneficial USDA financing, you should budget some more hours for this phase because it can get stretch new closure processes by a number of months at least (or even even several weeks, when the one thing try not to wade just like the smoothly). The financial will be able to give you an authentic timeline regarding what to expect due to each step of the mortgage approval process.

When you are to order a property and you may believe both you and your neighborhood you are going to qualify for a great USDA mortgage, contact your financial to begin toward app and pre-recognition processes. If you find yourself to shop for on eligible areas of better Atlanta or the surrounding outlying areas, contact Moreira Group today to see if a good USDA loan was effectively for you. We’re a beneficial USDA-accepted home loan company and we also makes it possible to explore any a home loan alternatives.

Deja una respuesta