Domestic Plus Federal national mortgage association HFA Prominent Loan System

The fresh Washington Traditional House In addition to mortgage program is very preferred because it has the benefit of direction which you can use to own downpayment and/otherwise settlement costs equal to to 5% of your home mortgage.

A portion of the benefit to a normal financing would be the fact discover significantly more independence associated with mortgage insurance. Conventional funds wanted home loan insurance rates in the event your advance payment is actually shorter than simply 20%; although not, you have the accessibility to deleting it subsequently.

A separate work for would be the fact mortgage insurance is generally lesser which have good traditional financing as opposed with a good FHA loan. Therefore, your payments might be lower.

Arizona Conventional Household Also System Features

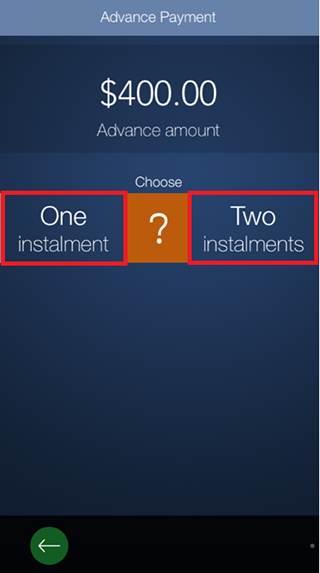

- Advance payment guidance alternatives to 5%. You could potentially choose what is good for you according to your financing scenario.

- No first-time house buyer requirement for very applications.

- Licensed members of this new You.S. military (effective and you can Experts) meet the requirements getting an additional step one% from advance payment direction.

- The money is continually offered.

- The support money received try a silent second which is forgiven monthly along the basic 36 months off owning a home. The fresh new lien is totally forgiven when you stay static in our home for a few years instead of refinancing. The reason for the latest silent 2nd is always to promote stability and guarantee the constant success of your house Also Advice System during the Washington.

This program comes from brand new Fannie mae HomeReady program and you can is amongst the Washington old-fashioned Household Together with mortgage software provided. It is considering any place in Arizona.

Family Including Freddie Mac computer HFA Advantage Mortgage System

This method is derived from brand new Freddie Mac Domestic Possible Advantage system that is one other Arizona antique Household Also financing applications offered. Its provided around Arizona.

- The house And additionally Federal national mortgage association HFA Preferred Financing Program now offers down percentage assistance options anywhere between step three% and 5%. You could potentially like what’s best for you based on your mortgage scenario.

- Your house In addition to Freddie Mac HFA Preferred Mortgage Program also offers off fee assistance alternatives between step 3% and you will 5%.

- Minimal FICO rating is 640.

- Restrict personal debt-to-income of fifty%

Essential Mortgage Disclosure

When asking on the financing on this site, this is not a loan application. This is simply not a deal to lend and then we are not affiliated with your home loan servicer. On the completion of your own query, we shall work tirelessly to help you having an official loan software and gives loan product qualification requirements for your private state.

Whenever applying for that loan, i are not need you to give a valid social shelter count and submit to a credit score assessment. People who do n’t have the minimum appropriate borrowing from the bank expected is unrealistic to get recognized. Minimal credit scores will vary predicated on financing unit. Any time you dont be considered according to research by the necessary minimal credit history, we might otherwise will most likely not introduce you to a card guidance services or credit update organization which might or might payday loans for disabled veterans not be in a position to help you with boosting your credit getting a charge. People financing merchandise that we could possibly give you often hold charge otherwise costs and additionally closing costs, origination products, and/or refinancing charge. In most cases, charge or will set you back can add up to several thousand dollars and will be due up on the fresh origination of the loan device.

This site is within absolutely no way associated with one reports origin or bodies providers that will be perhaps not a federal government institution. Not associated with HUD, FHA, Virtual assistant, USDA, FNMA, FHLMC or GNMA. This site additionally the organization one has this is not in charge for all the typographical otherwise photographic errors. If you do not agree to our terminology and you may guidelines, please exit the site instantaneously. If you fill out the mobile amount on this web site your consent to receive sale dependent sms. Agree is not required for purchase. You are going to discover to 4 messages 30 days. Practical text message and you can study prices may incorporate. Reply Stop to end & Help to have assist.

Deja una respuesta