Settlement costs is the charge recharged of the financial to procedure the mortgage

- FinancingThis term lines the kind of money you want to receive, like the loan amount, advance payment, interest, products or any other right regards to the mortgage. While incapable of get these types of conditions, the acquisition package was voidable.

- InspectionMany home enjoys at least one big, high priced problem. This term states that you will buy a specialist assessment of the property. If the faults can be found, you could withdraw your own offer, discuss less speed otherwise have the provider fix the problem.

- AppraisalThis makes you withdraw the bring otherwise query that the rate getting paid down if your appraiser costs our home lower than the purchase price you have offered to pay.

- Personal propertyTypically, whatever isnt permanently attached to the home is felt individual property. If you want the seller to leave significant devices, window treatments, lighting fixtures and so on, checklist all of them on package.

There are many other possible contingency clauses that you may need to include in this new bargain, dependant on your circumstances. After you are completed with new package, it would be published to the seller having his approval. Owner could possibly get invest in the price and you may terms and conditions and you may sign the brand new deal, so it’s lawfully joining to the couple. Additionally, the seller does not accept the first offer and can present a good counteroffer to the buyer. The initial render will then be terminated, and visitors need to choose whether or not to deal with the latest the arrangement. It is common to have counteroffers to get demonstrated a few times until both the visitors and you may supplier was met. When the a final provide is decided, Alaska bad credit personal loans the consumer have a tendency to move on to support their end of the deal by acquiring an interest rate, installing an inspection, organizing getting homeowner’s insurance policies etc. Just after most of the contingencies and requires was indeed fulfilled, the deal will proceed to new closing processes.

Closing

Closing is the legal techniques through which the customer will get brand new certified proprietor of the property. It requires an official conference attended from the visitors and you will merchant, their particular brokers and lawyer, and a real estate agent regarding the financial institution. Several important areas of new closing techniques is actually talked about within this part.

Closing costs

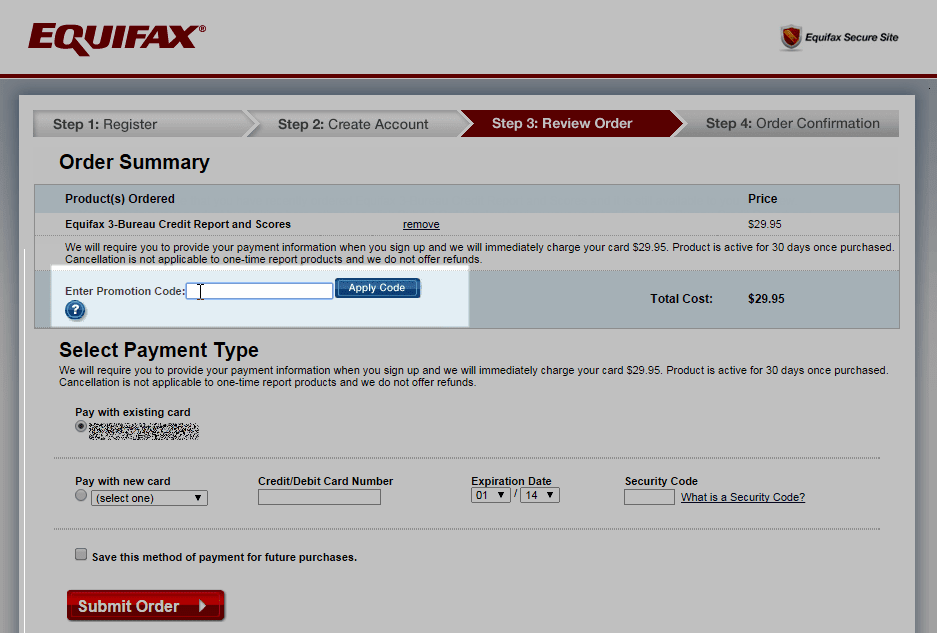

Loan providers try legitimately required to render people a good faith guess of your own amount of the closing costs no more than about three working days after a person fulfills out a loan application. Closing costs also include every charges to your those who promote properties from sale and get of the home. Specific closing costs range from the next:

- Application for the loan costs and you may credit file;

- Financing origination percentage;

- Points;

- Identity research and you will insurance premiums;

- Attorneys charges;

Settlement costs range any where from several so you’re able to eight % of one’s price of the home (this won’t through the downpayment). The consumer always will pay for most of the settlement costs. not, particular fees was negotiable and the purchase arrangement is also county and this of your closing costs the vendor will pay.

Term insurance coverage and appear

A name states who has judge control off a bit of property. When selecting a property, the consumer must be able to prove the provider indeed is the owner of our house so the financial institution to help you accept the latest mortgage. To do it, a bona-fide property attorney otherwise term insurance provider commonly conduct a good term research, which involves searching public record information to decide the seller keeps the latest legal rights with the assets. The brand new label research suggests if or not other people has actually legal rights towards the house courtesy judgments, liens otherwise delinquent taxes. The seller is frequently guilty of purchasing brand new correction away from people complications with the new title.

Deja una respuesta