Which are the different kinds of lenders around australia

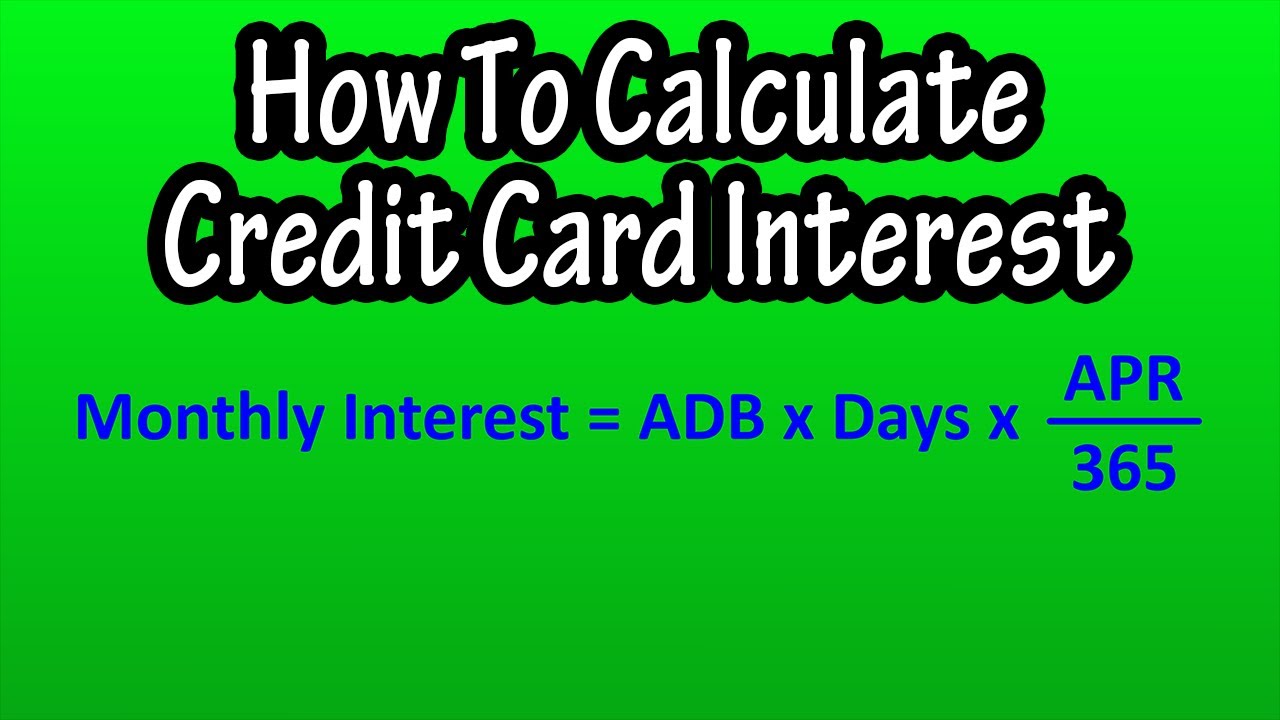

The eye you will be billed for each homeloan payment is founded on the kept loan amount, labeled as the loan dominant. The pace from which other appeal is actually recharged on your own financial dominating was shown due to the fact a portion. Your house loan’s interest rate was efficiently the price of buying the cash you employ to shop for assets.

As mortgage brokers are covered from the property value the house, very lenders thought all of them safer than simply very signature loans or loans, very their attention prices usually are far lower. You can utilize a mortgage payment calculator to decide simply how much the monthly money are usually a variety of mortgage models at the various other interest rates.

And the rate of interest, loan providers aren’t enforce certain fees, such as for example mortgage software costs, annual charge, later fee charge, more cost charge, an such like. These charge is rather contribute to the general cost of their financing.

If you choose financing with more provides, including a redraw business or a counterbalance account, you may have to spend an additional payment or a high interest rate. Yet not, these characteristics is highly good for some borrowers when you look at the effectively controlling their property mortgage.

It is vital to consider the costs and you can professionals just before committing to a specific mortgage. While you are increased percentage or interest may sound daunting, the added has actually could potentially save you money regarding much time focus on or bring valuable liberty. Meticulously assess your financial situation and you can goals and work out the best choice one aligns with your needs.

There is absolutely no one-size-fits-every finest financial type of. Selecting the most appropriate home loan involves because of the varied variety of solutions, because there is not any universally finest possibilities. There are different varieties of mortgage brokers in the business customized into the differing need from individuals. They truly are design funds, connecting finance, reduced doc financing available for the new notice-operating, contrary mortgages, and more.

From the knowledge your requirements out of home financing, you can find the ideal home loan types of for the novel problem and requirements. By way of example, if you intend to create otherwise substantially upgrade a house, a homes financing is generally most useful suited for your situation.

Take the time to see and you can examine the many mortgage choice in the market to decide a mortgage one is best suited for your needs. Imagine speaking to a mortgage broker for additional info on your own solutions.

What type of interest rate works well with you?

When comparing lenders, that very first solutions will be deciding anywhere between a predetermined otherwise adjustable interest rate. Exactly what really does which means that?

- Fixed speed mortgage brokers

- Changeable rates home loans

- Broke up rates mortgage brokers

Are you buying your first house or a residential property?

You should buy property making it your property otherwise utilize it as the a rental so you can enhance your income. Depending on how you should utilize the possessions, you might choose from a manager-occupied otherwise buyer mortgage, both of which come with assorted groups of has actually and you may cost.

- Owner-occupied mortgage brokers

- Money spent home loans

- Interest-just financing mortgage brokers

Probably construct otherwise dramatically upgrade a property?

Building your ideal household otherwise creating tall renovations requires just eyes, but also specialised money that provides the unique requires off framework ideas.

- Manager creator mortgage brokers

- Build loans

Trying to find a far greater price or provides on the an existing mortgage?

If your most recent home loan no more suits the money you owe or the market has changed, refinancing can offer a path to better interest levels, straight down monthly obligations, otherwise enhanced loan has.

Deja una respuesta