LendingTree isn’t a mortgage lender otherwise agent

Regardless if you are wanting a home loan, car, team, otherwise a personal loan, LendingTree now offers many informational information and tools to aid you’ve got an educated sense and reach your needs.

Credit self-reliance 4.eight Easy software 5.0 On line experience 4.step 3 Minimum downpayment 3% Minimum credit rating 580 Mortgage Points Given

Most useful Possess

- Rate prices and offers of multiple mortgage brokers

- Zero payment to access lenders within the system

- Flexible financing possibilities that have low-down costs offered

Drawbacks

- Credit Forest isn’t really a direct financial

- Zero online talk readily available

- Specific issues off too much phone calls and letters

Evaluation

The loan Account tends to be paid by the a few of the financial lenders we remark. But not, this does not connect with our very own opinion techniques or perhaps the feedback lenders found. Every critiques are manufactured on their own because of the our article cluster. I remark products out-of spouse loan providers together with lenders we really do not run.

If you’re looking to possess a single place to compare rates advice, LendingTree brings totally free price rates for the hundreds of lending products, in addition to mortgage loans and you will domestic security financing.

You will need to look at rates regarding a number of some other loan providers before buying, to help you certain regarding the having the lowest price for the their mortgage.

Dive So you’re able to Area.

- What’s LendingTree?

- LendingTree home loan review to own 2025

- Coping with LendingTree

What’s LendingTree?

Its an online credit marketplaces one to connects consumers having lenders. When you are buying otherwise refinancing a house, you are able to the working platform to acquire doing five price estimates. Read on to possess an in-breadth LendingTree remark and view several choices for your home financial.

Based inside 1996, LendingTree is just one of the prominent bank opportunities in the nation. Since its beginning, the firm possess assisted 111 million some body and you can acknowledged step 3 billion financing. Some make use of the platform examine mortgage lenders, it’s also possible to utilize it examine auto loans, unsecured loans, credit cards, and more.

Investigations looking is crucial when buying a home otherwise refinancing an excellent home loan. Financial cost differ by the lender, and receiving a knowledgeable speed could save you currency. You can pay a lower life expectancy payment per month much less focus across the life of the borrowed funds.

Since the LendingTree actually a lender, it doesn’t agree home loan programs. Instead, you are able to done an internet loan request, from which section LendingTree ahead your details in order to loan providers in its system.

According to research by the information you give, LendingTree fits your that have appropriate loan providers. These firms often get in touch with you with their provide.

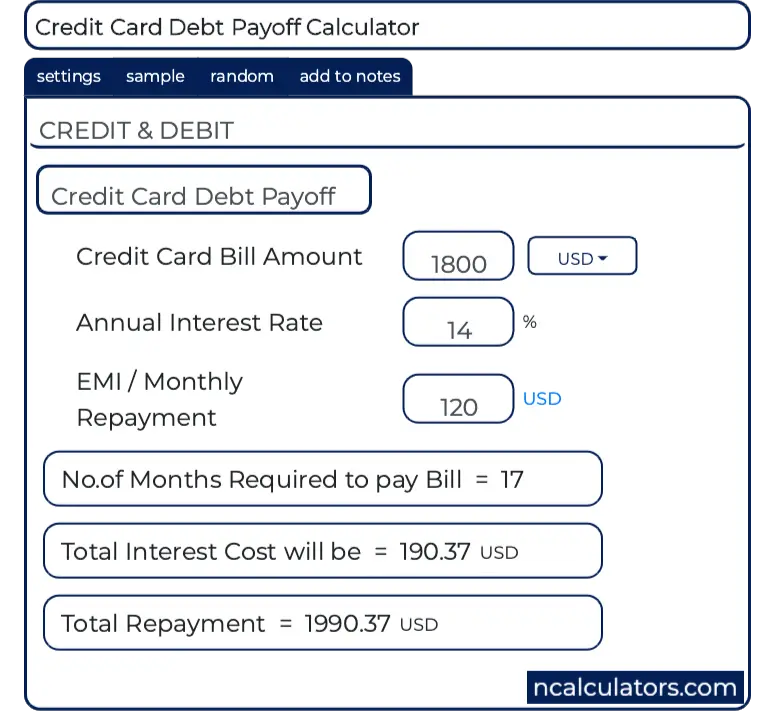

Because you read the web site, you’ll find a great deal of helpful information. This can include average pricing a variety of brand of mortgage brokers and financial price styles for the past 90 days. You can also utilize cost calculators you to definitely guess monthly installments established to the family rates and you can interest rate. Additionally, LendingTree provides academic issue on home loan process, so you know what to expect all of the time.

Dealing with LendingTree

Our LendingTree opinion revealed the entire process of bringing a rate price compliment of LendingTree is quick and you will straightforward. The site streamlines brand new consult process. Ergo, you merely offer your data just after.

To begin, enter into your Postcode as well as your reason behind implementing. Put simply, will you be providing a mortgage for a special buy or refinance?

Quoting your credit score is important because the minimums are very different because of the lender. Otherwise understand your own rating, you could purchase it online ahead of submitting a consult.

LendingTree forwards your information to help you their loan providers, and you can quickly after that you are getting around four offers. From here, you will need to meticulously contrast for every single provide like the interest rate and you will financial charges.

Be mindful one LendingTree couples having find loan providers. To be certain getting the greatest offer, it is possible to request a quote right from your local lender or credit partnership.

After you’ve chose the best selection and you will financial for your home mortgage, you’ll be able to complete a proper mortgage app to start the acquisition otherwise re-finance processes.

Complete, LendingTree mortgage critiques was self-confident. The web marketplaces keeps a score out of 4.5 out-of 5 toward Trustpilot. In addition, it have an one+ get to no wait cash advance Sail Harbor, CT the Better business bureau, and you can Consumer Factors supplies the web site cuatro of 5 celebs.

Most of the time, users preferred the convenience and you can convenience of the loan demand processes. Of many consumers found a superb bank through the system, which includes describing their financial agencies just like the educated, of good use, and you may elite.

Someone else sensed their lender’s closure process are quick and you can issues-totally free, and a few consumers stated toward less than requested home loan pricing and you can fees.

However, regardless of if LendingTree was a reliable company offering a very important solution, junk e-mail is apparently a primary grievance one of borrowers. Based on specific, immediately following submission its financing request, these people were instantly swamped having calls, characters, and texting.

Should you work on LendingTree?

If you are looking to own a simple and simpler way to contrast home loan rates, LendingTree is a great starting point. You can get around five lender even offers, that’s easier for those who don’t want to get in touch with lenders individually.

LendingTree is additionally useful for those who have a lesser credit history. As the platform just suits lenders which have individuals exactly who fit its standards, it is more straightforward to come across lenders one to complement high-risk consumers.

Although not, there’s the risk of spam, so you could become inundated with phone calls and you may emails after submission your own obtain rates rates.

Strategy

The borrowed funds Accounts considers several factors whenever examining loan providers. This type of points include borrowing from the bank and you will downpayment criteria, financing items considering, support service indications, and you can availability of on line devices. I up coming make use of these what to rating loan providers from inside the five categories:

Deja una respuesta