six. Favor a beneficial 203(k)-accepted lender and supply documentation

Identify a property that you want purchasing and you can renovate. Generate a detailed plan of your own advancements you need to generate, in addition to costs quotes. For a complete 203(k) mortgage, the package have to include at the very least $5,000 value of reline 203(k) loan should not go beyond $35,000 within the recovery costs.

cuatro. Favor the builders

The next phase is to acquire subscribed designers. Being qualified builders should be subscribed and you can insured, and so they normally have to stay complete-time team. You simply cannot have fun with family that do structure privately, and you also generally speaking can not carry out the performs on your own unless you’re a beneficial registered company of the profession.

The best results may come off experienced and elite restorations providers with done one 203(k) restoration before. Know that one to contractor’s refusal to do the mandatory versions you’ll reduce all of your project. So you may also wade as much as to type brand new 203(k) documentation criteria to the specialist agreement.

5. Get the estimates

Once your contractor is on board with letting you done https://paydayloanalabama.com/bayou-la-batre/ your own loan application, get certified offers. Ensure that the estimates commonly guesses. They have to be totally direct once the bank usually submit latest offers on appraiser, whom stimulates the worth of the job of the future worth of the property, upon which your loan would depend.

Switching quote buck number after you certainly will sustain most appraisal will cost you and you will bring about a re also-recognition towards the bank. Once more, make sure that your contractor understands all of this!

Its not all financial even offers 203(k) finance, so it’s vital that you come across a loan provider that is regularly this new specifics of new 203(k) mortgage techniques. Discover a list of accepted loan providers towards Agencies away from Houses and you may Metropolitan Advancement (HUD) webpages.

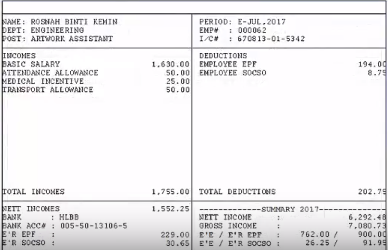

Try to promote a range of paperwork to help with the job. This may tend to be shell out stubs, W-2s, tax statements, facts about the money you owe, and you can a created proposal for the arranged renovations.

eight. Property appraisal and you will feasibility study

Getting a complete 203(k) mortgage, the lender often policy for a great HUD-recognized consultant to check out the house or property. The newest associate can do an effective feasibility study and you will feedback your own proposed developments to make sure they increase the property’s worth and see HUD’s Minimum Possessions Criteria and you will local code requirements. For an improve 203(k), a consultant is not needed, nevertheless the assets commonly still have to become appraised.

8. Closing the loan

While the loan is eligible, it is possible to move on to closure, in which you can easily signal all the financing records. The brand new restoration money from your loan might be put in a keen escrow membership to be released due to the fact efforts are accomplished.

nine. Supervising recovery functions

Restoration works has to start within thirty day period out of closing the loan. Having the full 203(k) mortgage, you’ll run their representative to supervise progress.

With regards to the the quantity of one’s fixes, your age day. However for larger strategies, program to call home somewhere else until efforts are done. You could potentially money as much as six months out of mortgage payments on the your loan amount to allow it to be room on your own funds to complete therefore.

ten. Transfer to your renovated home

The job is finished, and you are the master of a lovely new home. You dependent home collateral early on, therefore did not have to take part in a bidding battle so you’re able to buy your most readily useful family.As well as, you may be capable re-finance outside of the FHA financing together with financial premium (MIP) that accompany they.

FAQ: FHA 203k mortgage

Fundamentally, very individuals exactly who qualify for an enthusiastic FHA loan could well be accepted getting a beneficial 203k loan, too. You’ll want no less than an effective 580 credit history (though some lenders wanted 620640). You will additionally you prefer at the least an excellent 3.5% downpayment according to research by the price in addition to resolve will cost you, enough earnings to settle the loan, rather than extreme present personal debt. While doing so, you must be to buy a house you plan to reside.

Deja una respuesta