Do i need to key mortgage brokers just after locking my loan?

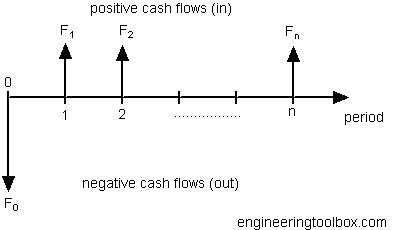

Every person desires get the very best prices and terminology – for good reasons. Actually quick alterations in home loan pricing can have larger monetary outcomes over the life of that loan.

Are you willing to key lenders just after an increase lock?

An increase lock arrangement together with your large financial company otherwise lender claims you are able to obtain at a particular interest, offered your property mortgage otherwise home mortgage refinance loan shuts up until the conclusion date of the rate secure months.

You will find basis so you can right back out from the home loan underwriting processes, but canceling once the newest mortgage pricing are down today than just whenever your signed the contract isn’t really usually included in this.

Nevertheless, that doesn’t mean you happen to be stuck with a higher level. You could potentially nonetheless make use of markets rates action. However, based your own lender’s rates secure plan, support aside could possibly get mean birth the mortgage recognition techniques everywhere once again with a new lender.

This is how to choose in the event that support out of your rates secure contract is good for your condition and private money.

What’s the part of home financing rate protected?

Loan providers and brokers use rates secure-ins to assist them approximate just how much trading they do for the the newest up coming months. When you find yourself homeowners and you can residents can be be assured that they’re secure against financial speed increases prior to its financing closes.

As to why switch lenders immediately following an increase secure-when you look at the

Suppose that your secure a thirty-year repaired-speed financial at the a good cuatro.5% speed for a month. And a week later, the business rate drops to help you 4.25%. Would you take the straight down interest, otherwise have you been stuck?

Even if you go through Go Here the conformed expiration go out, and do not close for the 29-big date rate secure months, extremely loan providers wouldn’t supply the straight down rates during the closure. You’ll receive sometimes the speed you locked, 4.5%, otherwise a higher rate when the rates of interest increase in advance of the loan closes.

One method to end this might be by opting for a float-down alternative you to definitely allows you to personal on a lesser price when the interest levels slide while you are secured.

Float off solution

A float off option is a supply longer by your loan officer that will allow that miss your own locked-from inside the rates to the current financial rates just before your closure day.

Some lenders would not charge you a beneficial secure commission, there was an additional percentage getting a float down solution, but it is will put in your own closing costs.

It’s not constantly regarding straight down financial cost

However, money is not the only real matter. An unreactive loan manager otherwise missing paperwork can lead to debtor disappointment – and you can a desire to look around.

Know that you happen to be absolve to key loan providers anytime during the the method; you’re not dedicated to a loan provider up to you indeed finalized this new closure files.

But if you manage intend to key, re-creating documentation and underwriting may cause delays in your home pick or refinance processes. This is certainly a bigger exposure when you’re not as much as price to order a home before a set closure time.

Look one which just protect

One more reason to possess borrower uncertainty issues the pace shopping process. In many cases, individuals do not research rates when purchasing or refinancing. It ponder: could i do better? And you can halfway from financing procedure, they know they may be able, as well as initiate over with a different lender.

With regards to the Individual Financial Shelter Agency (CFBP), studies have discovered that over 31% out-of borrowers stated maybe not comparison in search of its mortgage, and more than 75% regarding borrowers stated obtaining home financing in just you to bank.

Earlier Agency browse means that failing to look around getting a great home loan costs the common domestic customer up to $three hundred a-year and several several thousand dollars along side lives of financing.

Deja una respuesta