Example month-to-month costs having an effective ?60,000 home loan

- Event all the requisite documentation for your software: Their broker will be able to assist you from application procedure and all of new records you will need evidence of income, at the least 3 months from bank statements, personal ID, proof target, evidence of deposit, newest P60 means an such like.

- Exercise simply how much you might use: You could assume that ?60,000 is the restrict you can borrow getting a home loan established with the regular bank income multiplier calculations. Although not, this could never be the situation. A large financial company can evaluate your needs and you will eligibility for top income out of loan providers, potentially enabling you to obtain even more within finest interest rates.

- Finding the right financial and protecting the best price for your requirements: Your mortgage broker can select those loan providers giving the best rate of interest terms offered. This may help you save some time, possibly, some money as well.

- Powering your through the mortgage techniques: Obtaining home financing will likely be tricky, especially if it’s your first app. Suitable mortgage broker will help you with one products your could possibly get find along the way, shield the welfare, and gives service if the something goes wrong.

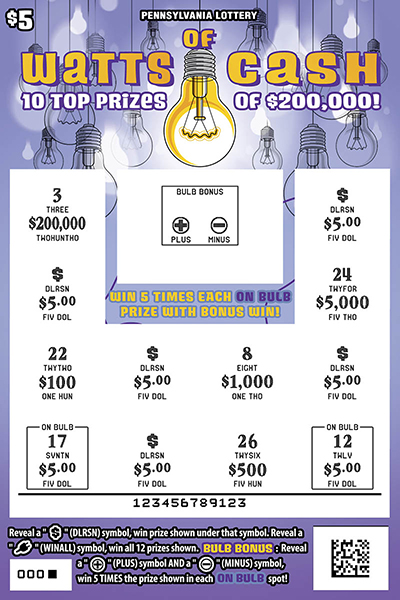

That it desk outlines various monthly premiums for good ?60,000 financial centered on interest rates between step 3% and you will 6% over identity lengths out of 10 in order to 3 decades.

Towards the Lender from England base speed currently at the 5% () and the average mortgage speed ranging from 5% and six%, brand new payment figures of these columns on dining table would be more sensible currently. Although not, this may alter as the legs rate decreases in the future and you can lenders pursue suit.

To have desire-just mortgages, this new repayment stays as well as regardless of the label. Therefore, such, the latest payment shown to own 6% ?three hundred monthly are definitely the same if you preferred a good fifteen-year- or 31-seasons label because capital due cannot beat in fact it is repaid out of in full at the end playing with an alternative payment automobile.

For the true purpose of it table, i assume the interest rate remains the same on the full period of the mortgage. Rates can transform if you choose to remortgage to a unique speed or go from a fixed otherwise deal bargain about the lender’s simple variable price (SVR).

Circumstances affecting monthly money

And the facts mentioned above-interest, loan label, deposit, financial particular, and you can cost method-your instalments is also affected by a number of other things, such as your ages and you can credit history. These could reduce quantity of loan providers happy to consider carefully your application.

A brokerage tend to examine these and you will fits your towards correct financial. However they access exclusive deals and can discuss having lenders on your behalf, helping you save one another time and money.

Interest rates

Having the best rates of interest depends on a lender viewing you as a trustworthy borrower. A broker can indicates on the best way to fill in a strong financial app and display and this financial providers are currently providing the ideal rates.

Fixed otherwise Tracker

You will have the choice to decide anywhere between a fixed rates vs an excellent tracker home loan. Always, a predetermined rate could well be high, boosting your monthly cost. But, locking in a cash loan Coaldale, CO performance makes it possible for that plan your finances beforehand. An effective tracker financial often match newest rates, which will produce higher repayments if your rates was raised.

Name Length

The fresh new extended the definition of, the low their month-to-month repayments would-be. Usually, home loan words was absorbed twenty five years, but now (with regards to the applicant’s years additionally the fuel of its app), mortgage conditions can also be continue as much as forty years.

Deja una respuesta