Just how A processor Opposite Mortgage Operates to Change Your own House’s Guarantee Into Income tax-100 % free Dollars

The expenses differ with regards to the version of contrary home loan you’re taking. The expense with taking an opposite home loan include closure fees, charges to possess separate legal counsel while the pricing having a property assessment.

There is absolutely no advancing years particularly residing in the home you adore. If you find yourself like any Canadian property owners ages 55+, the majority of everything very own suits to your 1 of 2 categories new collateral in your home and also the money you really have spared. Chances are that the worth of your home has grown over the years and you will makes up an excellent percentage of your net worth. As well as have a house who’s got liked within the worthy of is a good confident, you normally cannot purchase one to worth if you do not offer your property. An opposite Financial enables you to appear to help you 55% of appraised worth of your residence security on the tax-totally free dollars. In addition guarantees you have access to the funds whenever you want to buy. You can easily look after complete control and control of your property without the obligations while making typical mortgage payments if you don’t disperse otherwise offer.

Simply how much Can i Be eligible for having a contrary Home loan?

Which have a processor Contrary Mortgage you have access to doing 55% of appraised value of your residence from inside the income tax-free cash. The degree of bucks that you be eligible for varies according to individuals points for instance the value of your property, brand of house (condominium, townhome, semi-isolated, isolated, etcetera.), place of your property along with your ages.

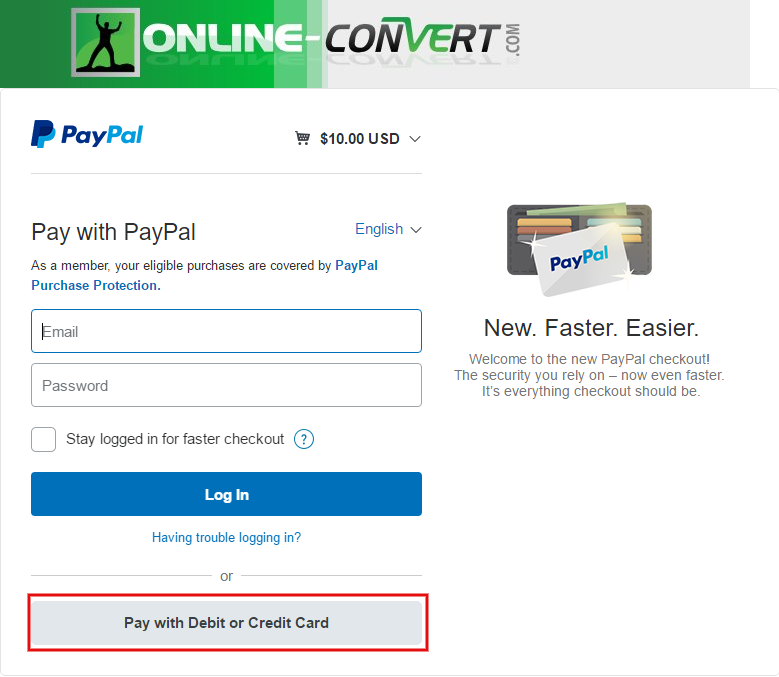

To find out exactly how much taxation-100 % free cash you could potentially be eligible for off a processor chip Reverse Financial, try our contrary mortgage calculator.

Just what Reverse Mortgage loans Can be used for

In the place of of several traditional loans, having to-be to possess a specific mission (such as a car loan) the funds you receive out of a face-to-face home loan can be used getting certainly things. Check out of the very preferred means Canadians utilize the funds from a reverse home loan:

- Stay in your house and avoid needing to disperse, sell otherwise downsize

- Boost advancing years money and money flow

- Assist nearest and dearest financially (instance, to buy property otherwise purchase a married relationship)

- Remodel your home (commonly making much-called for advancements otherwise assistance with versatility points)

- Pay back highest appeal expense

- Travelling more frequently

- Buy another property

- Shelter fitness expenditures, in addition to inside the-homecare

- Loans the sort of old age you constantly imagined

Benefits associated with an opposing Financial

There are several secret benefits to taking out fully a reverse mortgage, especially when than the a conventional mortgage or mortgage. That have a processor Contrary Financial, you are able to stay static in the house you love and keep complete possession and term, without having to flow, offer otherwise downsize. You will get a lot more economic freedom without having to drop towards retirement deals and therefore makes payday loans online Vermont you leverage what exactly is most likely one of your premier possessions and turn as much as 55% of one’s appraised value of your residence into the income tax-totally free cash. No month-to-month mortgage payments are required, and you may spend the money however favor. You might have the money in a lump sum payment matter or into the typical monthly premiums. Just like the value of your property grows historically, you are able to supply extra guarantee. Due to the fact financing was reduced, nearly all HomeEquity Financial people otherwise its heirs have currency left over.

Considerations out of an opposing Home loan

The interest cost are typically more than old-fashioned mortgages or HELOCs, so when having one loan the bill increases throughout the years. When your financing try paid off in the first 5 years, there can be early fees fees. Ultimately, you are borrowing up against the property value your residence and could not be able to obtain more income by doing this throughout the upcoming.

Deja una respuesta