Pre Recognition against Pre Qualified vs Underwritten Pre Approval: Whats Everything Mean?

- Composed toward

- step three minute comprehend

Dena Landon try an author along with a decade of experience and has had bylines are available in The fresh new Arizona Post, Spa, Good Housekeeping and. A resident and you may real estate individual by herself, Dena’s bought and sold five home, has worked inside the property government to many other buyers, possesses written more than 2 hundred posts to your a property.

Jedda Fernandez try a member refresh editor to have HomeLight’s Financial support Stores with over 5 years from article experience with the actual estate industry.

When you are getting ready to start looking land, you’re probably hoping for extra space, a big lawn, or a storage unlike reasonable financial interest levels. However, failing woefully to get preapproved just before house searching can result in heartbreak. Do you know the difference between pre recognition vs pre qualified when it comes to mortgages?

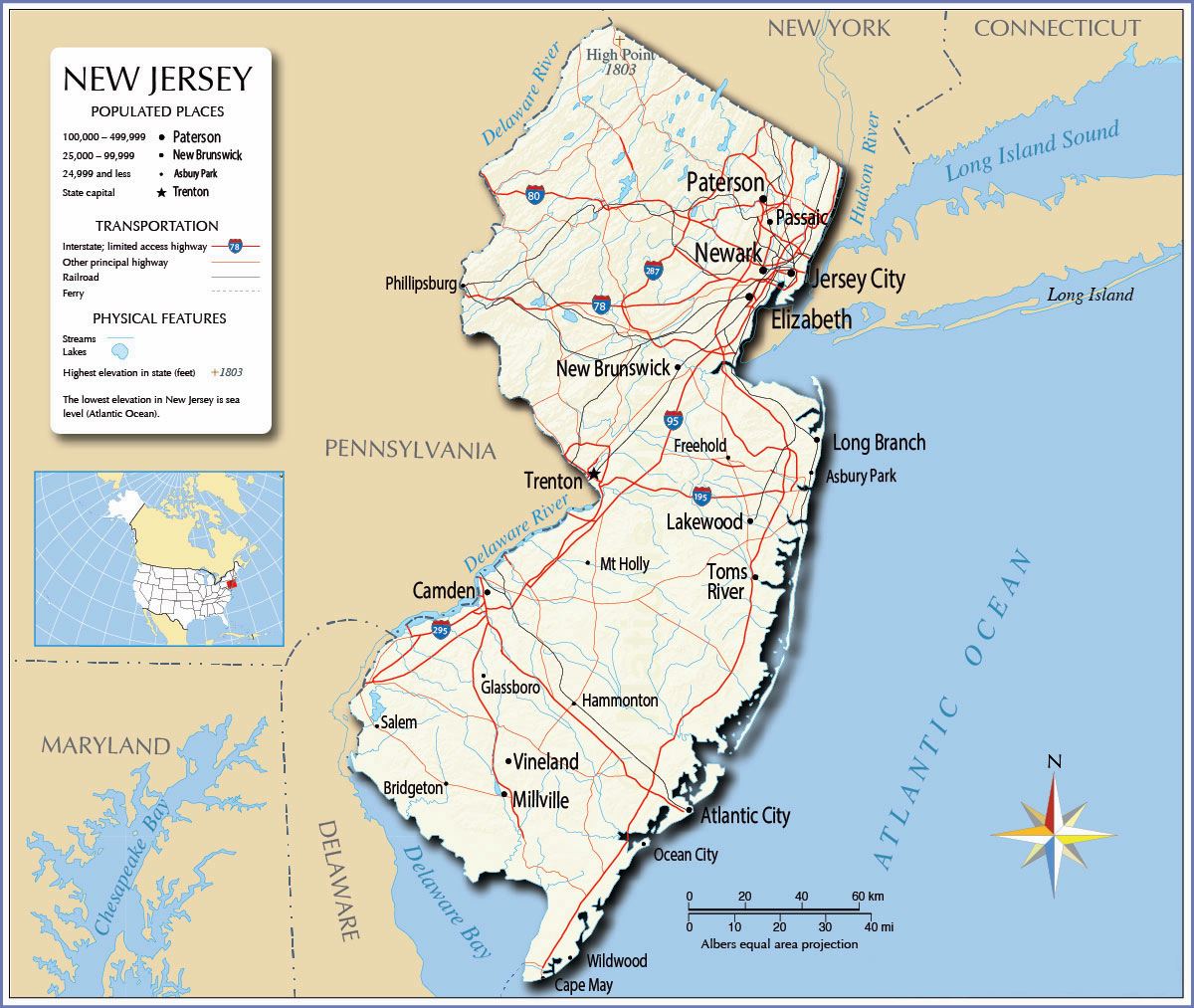

HomeLight can also be link your which have a premier real estate agent common with the mortgage software processes and you can home posts near you. I get acquainted with more than twenty seven million deals and you will thousands of studies to help you determine which broker is the best for you based on your position.

Marcus Rittman, movie director from home loan functions within HomeLight, possess viewed you to definitely new catalyst for the majority people seeking to get acknowledged to own a good financial is seeking a house that they love. The issue is, once they have not been preapproved, they might be scrambling to track down accepted and can miss out on a house because it takes time.

Don’t let that getting you! Here is what you need to know regarding pre approval compared to. pre qualified compared to. underwritten preapproval and that means you learn what type you want ahead of traveling the first family.

Exactly why do you ought to jump courtesy these hoops?

Chris Austin, a skilled representative about Kansas City, Missouri, area, warns that should you start family searching without getting preapproved, You could be expanding a preferences having something you can’t afford – or possibly you really can afford more than you think. An excellent preapproval helps you establish your home searching funds.

Very realtors would not focus on buyers up to they have spoke to help you a loan provider, so they possess a very clear notion of what you can pay for. Vendors in addition to favor also offers out-of preapproved people as the there can be smaller chance to them the give commonly fall courtesy. The brand new much time as well as the short of they: Getting preapproved makes it possible to vie about housing industry.

If you wish to pick property, the financial institution otherwise lender will need to understand how much currency you create as well as how far financial obligation you’ve got. You will find several different methods one to loan providers can do so it ahead of you may be actually obtaining home financing, and lots of become more strong as opposed to others. Let us have a look at differences between pre approval compared to pre certified against underwritten pre approval.

Prequalification

Once you begin the new prequalification process, you can express your earnings and you will debts with lenders – however in most cases, they won’t ask you for confirmation.

To https://clickcashadvance.com/personal-loans-nj locate prequalified to have a mortgage loan, you just need to condition information, maybe not prove they. Rittman claims which you yourself can express your earnings, debt, and you can available down-payment.

Centered on one, according to him, the fresh new systems commonly saliva aside a variety and you can state what you’re prequalified for. But nothing has been affirmed.

The lenders will most likely also look at your credit history and use it, together with suggestions your disclose, to present a great ballpark matter based on how far currency you can be acquire. Providing prequalified is a sure way to evaluate your financial budget – but most sellers aren’t probably deal with an offer based on an effective prequalification; it is far from airtight adequate. Predicated on Rittman, it’s better utilized while the a guideline.

Preapproval

Good preapproval is a step right up regarding good prequalification (whether or not sometimes these types of words can be used interchangeably, in fact it is difficult). Plus filling out the majority of a software and revealing income, you’ll continually be asked to fairly share some records along with your financial lender(s) to simply help confirm just how much income you have plus obligations load.

- A couple of years regarding tax returns

- W-2s and you can 1099s (for freelance money)

- Shell out stubs

- Profit-and-losses comments having notice-employed anybody

- Letters away from explanation to have gaps from inside the work

- Evidence of other forms cash (real estate, child service, alimony, etc)

- Way to obtain this new advance payment financing

The lending company may also demand even more records when you yourself have unique situations, eg a last property foreclosure or bankruptcy. Everything you the lender asks for helps them verify what you’ve considering them regarding your possessions and you may expenses.

An excellent preapproval is considered a beneficial conditional dedication to give, but your final mortgage approval nevertheless is determined by the latest profitable conclusion of one’s complete underwriting process. In lieu of an effective prequalification, since it is at least partially affirmed, it has to has actually a particular credit limit and might become facts about your interest rate and you may words.

Once you create a deal that’s accepted – which is more likely with a great preapproval than which have good prequalification – therefore bring a valid purchase agreement, their lender will finish the underwriting technique to clear their financing to shut.

Deja una respuesta