What are the results when a debtor struggles to Pay that loan

Consumers need certain rights and you may laws and regulations one to seek to enable them to with payment however if they default on the money to have a real cause. Assistance put forth by RBI besides support banks and you will loan providers discover their repayments and in addition handles the newest liberties out of consumers.

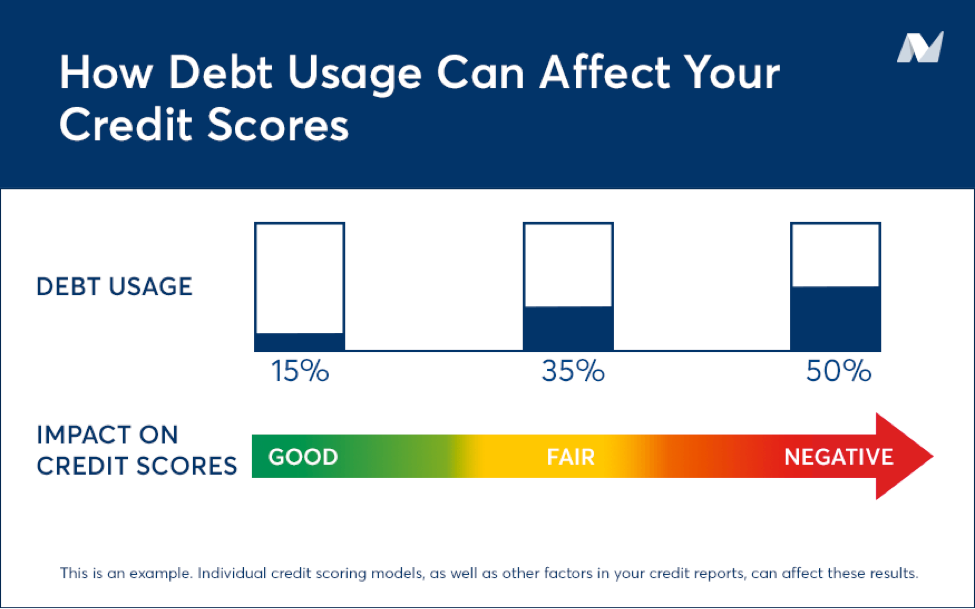

- Impact on the fresh borrower’s credit rating

Defaulting or postponing the EMI percentage leads to reduction in this new credit rating and will negatively affect the borrower’s upcoming borrowing from the bank capacity, stopping your/their unique out of without difficulty providing finance down the road.

- Reminders because of the Lender

Most of the debtor are entitled to researching a set quantity of reminders and you can notices from the lending institution. When the a keen EMI was delayed once or twice, sees was sent regarding the late repayments.

However, if the reminders and you will notices are not heeded from the borrower and EMI isnt repaid regardless of this, subsequent action could be drawn because of the financial such as for instance marking brand new borrower as a non-performing advantage otherwise NPA. This may avoid the borrower from choosing whichever loan or borrowing later.

- Charges and Lawsuit

In case notices and you will reminders do not improve financing being cleared, lenders will get impose penalties towards borrower or even capture court action.

A missed fee of a few weeks can still be rectified but if the fee wasn’t made for more a month or a few, it can end in big damages.

In the event that a guarantee could have been given, it put as a way to recover the loan by taking fingers of the identical.

Legal action Against Loan Defaulters

Infraction off package regarding loan installment itself is maybe not a crime however, lenders is method a civil legal during the order to recover a similar.

In the event the financing wasn’t paid off for more than 180 months, the financial institution is actually permitted to document a case resistant to the borrower around Point 138 of your own Flexible Instruments Operate off 1881 .

Sometimes unavoidable affairs prevent individuals away from loan places Nucla having the ability to pay-off the loan.. Instance times won’t be thought to be cheating’ but rather the financial institution may run this new borrower because of the changing the newest repayment items in order to make sure the mortgage try paid back.

Although not, in case your goal of the latest borrower is proven to be deceptive close to the time off stepping into the loan arrangement, a violent instance would be submitted from the defaulter.

- Default despite having the capability to shell out

- Diversion of financing or financing

- Fingertips otherwise transfer of collateral considering since the shelter without having any training of the financial

Legal rights of every Loan Defaulter

Even if the debtor cannot pay the loan up coming he/she has particular legal rights in place. These are:

- Straight to Observe

This new borrower have to be given much time by the bank ahead of taking action to recuperate the fresh new outstanding amount or repossessing the house provided because equity

- Straight to Reasonable Well worth

Should your debtor is not able to pay the mortgage together with bank features repossessed the fresh new property offered, the value cannot be only dependant on the newest loan company. A fair really worth observe should also be provided for the fresh borrower informing your/their own of your marketing speed which was examined

- Directly to feel Heard

New debtor has got the straight to increase arguments for the notice of repossession sent from the bank inside notice several months.

In the event your lender receives a very high price for the new asset which had been repossessed from the them, new leftover balance shall be stated by debtor

Achievement

While availing that loan, borrowers need to ensure that they are able to pay-off the borrowed funds whenever you are fulfilling every small print. Choosing the right financial is even crucial because all the lending place also offers varied interest rates otherwise payment terminology. Candidates is get short and you will dilemma-totally free signature loans from just one really highly regarded mortgage team in the united kingdom, Currency Examine. The interest rate begins just 1.33% monthly because fees tenure is also expand around 60 months. Additionally, new eligibility look at enables individuals to search for the quantity of financing that they wish to obtain according to specific pre-put conditions and terms.

Deja una respuesta