How much Could you Acquire that have an income out-of 50k in the united kingdom

Combined software discover gates in order to large mortgages that may hunt aside from reach on a single money. It is important to go into such as agreements which have obvious insights and you will believe, as both sides getting similarly guilty of the mortgage payments.

Bank of England restrictions

When it comes to home financing, it’s important to understand the Financial regarding The united kingdomt restrictions. This type of regulations are created to safeguard borrowers and loan providers in the ever-growing world of mortgages.

The lending company off The united kingdomt limits how much banking companies can be provide from the imposing rules for the financing-to-income rates making sure that borrowers usually do not deal with more financial obligation than capable manage. Wisdom such limitations is vital whenever determining exactly what home loan you might score with a 50k salary in britain.

The lending company regarding England’s role in the managing home loan lending underpins the newest complexities of obtaining the right home loan towards a beneficial 50k income. They set limitations customized for the ensuring in control credit methods one of monetary institutions, an important idea whenever trying to more than just one simple financial sale in today’s market.

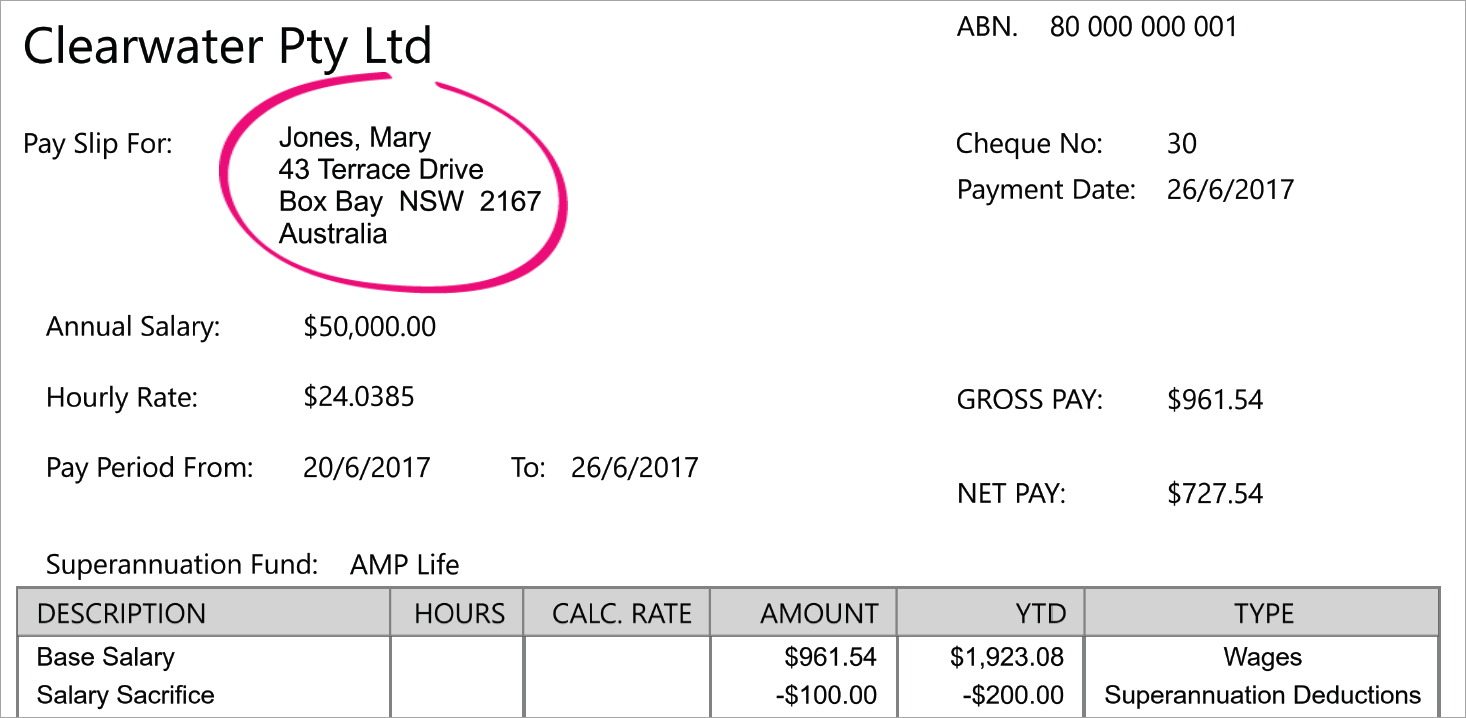

Which have a salary from 50k in the uk, you could use home financing count according to things particularly your credit rating and you can monthly costs. The eligibility may also rely on new perception of credit rating and exactly how bankruptcy affects it.

In depth considerations

When it comes to just how much home loan you can get into the a good 50k income in britain, you will need to cautiously assess your credit score. A good credit score makes it possible to secure a far greater mortgage offer, while a reduced get can get limit your possibilities or bring about high rates.

Understanding such in depth factors is essential when choosing the best mortgage for the circumstances and goals because a potential homeowner.

The latest perception from credit score

Your credit rating performs a serious part in choosing the borrowed funds count you might safe which have an effective 50k income in britain. A higher credit history develops your odds of being qualified to own more substantial mortgage during the beneficial interest levels.

On the other hand, a reduced credit rating may limit your borrowing from the bank capacity and you will influence in the highest interest rates, sooner affecting new value of monthly obligations.

Finding out how your credit rating affects your capability so you can safer a good home loan is a must when planning to pick a house. It is vital to frequently screen and you can improve your credit score so you can boost your economic status while increasing your odds of securing an enthusiastic optimal home loan contract.

Exactly how bankruptcy proceeding influences their qualifications

Case of bankruptcy can be notably effect the qualifications having home financing that have good 50k salary in the united kingdom. Declaring case of bankruptcy could possibly get stick to your credit history having right up in order to half a dozen age, affecting your credit rating and you can so it’s harder so you’re able to safer good home loan.

Loan providers could possibly get view broke individuals since high-chance borrowers, that’ll curb your selection otherwise lead to higher interest levels when you’re accepted to have a home loan.

If you have knowledgeable personal bankruptcy, rebuilding your credit rating and you can appearing in control financial conclusion over time normally improve your eligibility to own a mortgage. However, it is important to feel upfront from the any prior monetary challenges whenever obtaining a mortgage and look for qualified advice to pop over to this web-site boost their likelihood of approval.

Selecting the most appropriate Mortgage and other Factors

In relation to the best financial, first-date homeowners provides alternatives. Style of mortgage loans is repaired-rate bargain and you will adjustable-rate mortgage loans. The federal government now offers plans to help very first-date customers safer their houses.

Brand of mortgages for earliest-big date homeowners

- Fixed mortgage rate: The repaired rates financial Provide uniform rates of interest more a selected label, delivering predictable month-to-month home loan repayments.

- Variable-Rate Mortgage loans: Interest rates vary according to sector criteria, potentially causing lower very first money however, higher much time-identity can cost you.

Deja una respuesta