Exactly how a credit score Affects Your ability to obtain a home Mortgage

When you are currently looking for a home loan, you have issues about how a lender usually view their app. Money, field and age are all affairs that will possibly affect their capacity to secure a mortgage. However, your credit rating can be a significant factor their financial takes under consideration when researching the loan app.

Ergo, it is better so you can renew your understanding of your most recent credit rating , and you may consider if you could be performing far more to keep and/or increase it. Your credit score could potentially be the defining grounds if it relates to your creditworthiness put another way, just how appropriate you are for borrowing.

Why does a loan provider figure out my personal credit rating?

A loan provider will assess your credit score based on several factors, for instance the number of borrowing from the bank you have got reached in your life, who you accessed it of, and how an effective you had been at the investing it right back. And you can loan providers use various other algorithms to help you estimate your credit rating. Particular join the expertise of credit bureaus, other people improve computations internal.

If you are there are various methods away from calculating fico scores and overall creditworthiness, broadly, loan providers make up a comparable directory of products , including:

- Your existing finances

- Most recent income

- Discounts

- Paying habits

- Their credit history

- What number of minutes you’ve removed credit

- How much borrowing your taken out

- Your cost activities

- Your own a job records

It means if you find yourself gearing around initiate researching home loans, you should be conscious of stuff in the above Palm City loans bad credit list, and if or not any of them might appear on your own credit file because below excellent. You should also verify you’re looking at home loan products which give you value for money you can. Referring to where Canstar will help:

I’ve a dismal credit score. Can i score home financing?

If the credit rating isn’t as an excellent due to the fact you want it as, it will not necessarily mean that you can not rating a mortgage. not, you ple people with high rates and you will fewer keeps.

You’ll find lenders which specialise in home mortgage activities designed for those with quicker-than-best fico scores. Their products or services is almost certainly not as the glamorous since various other home financing, but they might possibly be a starting point worth idea.

For those who take action financial diligence, after a few years of being wise along with your money and you will and make repayments punctually, your credit rating will get improve so you can a time as much as possible re-finance your house mortgage which have a more glamorous interest rate.

My personal mortgage software got declined now what?

In case the home loan application is unproductive, this doesn’t mean you are out of choices. That being said, may possibly not be the best suggestion in order to immediately sign up for yet another home loan regarding a new bank. One of several points that may affect your credit rating try how frequently you has just applied for any type of borrowing otherwise mortgage, plus if or not you were effective or not.

It indicates your credit score could actually become straight down just after an enthusiastic software to possess home financing are refused. In this situation, you may want to consider concentrating on your credit rating, of the working out economic wisdom for most days. If you find yourself enhancing your credit score are easier in theory, it is not hopeless.

You certainly will deferring my personal mortgage or lost a repayment affect my personal credit rating?

For individuals who apply for a home loan deferral, providing you are not for the arrears , your home loan vacation shouldn’t adversely connect with your credit rating. However, consider, du band your holiday months your loan will nonetheless accrue notice, which often will then compound. So after the mortgage period possess completed, you can deal with a larger contribution to settle.

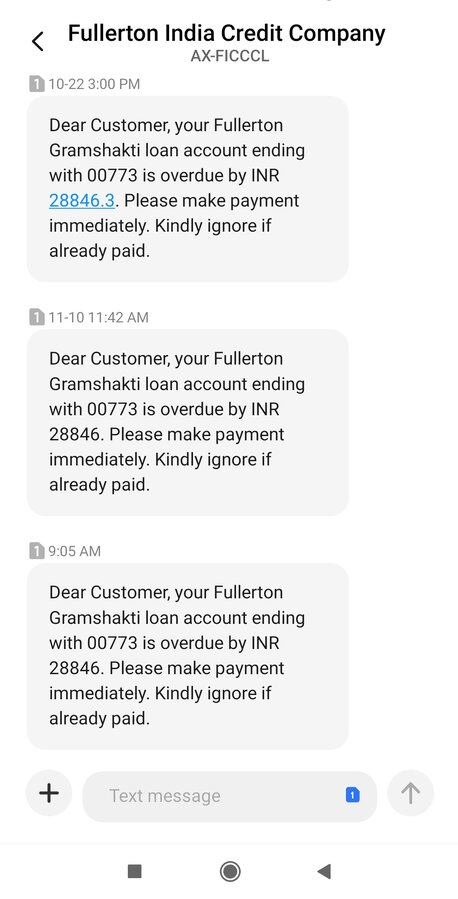

In typical items, a default for the credit can occur if you can’t spend an expected personal debt, such as credit cards repayment or loan. If for example the costs will still be unpaid, the supplier has a tendency to contact a credit get service in order to declaration this new default, that next show up on your credit report.

The crucial thing to keep in mind if you find yourself in mortgage be concerned will be to confer with your bank immediately. If you tell your financial you are in financial hardship and having dilemmas appointment their monthly costs, he could be obligated for legal reasons to help you within the establishing a reasonable repayment bundle.

How can i boost my personal credit rating?

Enhancing your credit history isnt something you is going to do quickly. But, for a while, you could evaluate the money you owe and set to one another an idea to assist show you into the a much better credit history.

Switching your credit rating to your better will likely be difficulty, but the eventually you begin, the sooner your credit rating you are going to initiate creeping upwards!

Concerning composer of this page

That it statement is actually compiled by Canstar’s Editor, Bruce Pitchers. Bruce have about three decades’ sense since the a reporter and has has worked to possess major media people in the uk and Australasia, in addition to ACP, Bauer Media Group, Fairfax, Pacific Guides, Information Corp and you will TVNZ. Ahead of Canstar, the guy has worked just like the an excellent freelancer, including for the Australian Monetary Remark, the fresh NZ Financial Areas Power, as well as for a home people on both parties of your Tasman.

Take pleasure in reading this?

You might such as for instance you with the Myspace and also public, or contribute to found alot more development along these lines to the inbox.

Deja una respuesta