How & When you should Fool around with Funding Contingencies

Couch potato Backup

That it says that home Buyer keeps a selected quantity of weeks to apply for and you will safe a company mortgage commitment out-of a bank or any other form of lender the one that could have been fully underwritten. (This is not an effective pre-acceptance as an alternative, this is how the loan underwriting processes has brought lay.)

In case the Client is better than the credit due date versus terminating the newest price or asking for an expansion (which the seller must agree to in writing), then your Customer keeps automatically waived the backup, definition the consumer features dedicated to promoting the loans required purchasing your house, whether or not the loan is actually eventually accepted or perhaps not. In such a case, because a purchaser, you would have to pay close attention to the newest calendar and be certain that you’re relying the days securely.

Active Backup

Brand new effective contingency is the 2nd most common sorts of money backup which is a tad bit more tricky and you may places a lot more of the burden up on your house provider.

Inside scenario, the credit backup addendum states the Supplier provides the correct so you’re able to terminate, however, only immediately following an assented-on number of days seats and simply immediately after providing notice to help you the consumer the vendor may always terminate the brand new price any time shortly after delivery away from like see.

Whether your Provider doesn’t serve it see pursuing the specified quantity of days in the backup, the financing contingency survives from remainder of the marketing processes. Consider this prospective observe such as the Merchant is waving the fingers and you can inquiring, Hello… what’s up along with your money?

If your house buyer has actually set up to invest in and contains started fully underwritten, then your consumer should match the financing contingency in the that point totally. In the event the, yet not, the consumer really does absolutely nothing immediately following finding so it see, then they are at chance of your house provider terminating the latest bargain any moment.

Since most money commonly totally underwritten until just before closing, extremely consumers will not volunteer to waive the financing contingency just like the in case your money fails, they’ll likely be susceptible to the newest forfeiture out-of serious currency. Just do it carefully is to which situation happen to you.

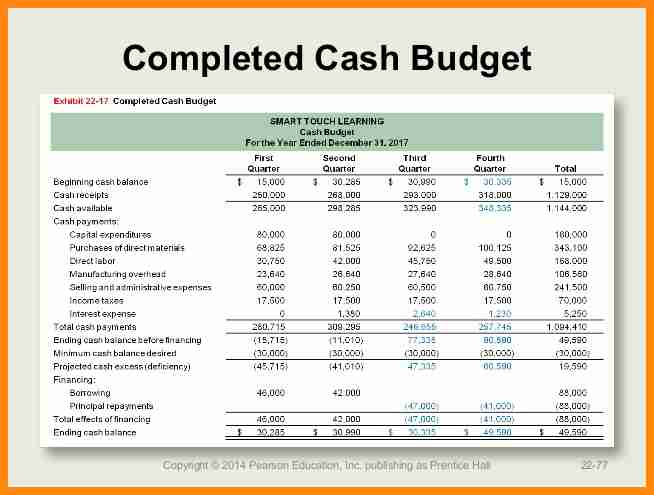

Knowing the subtleties off capital contingencies is extremely important when navigating new complexities out-of real estate deals. The following table illustrates various uses out-of money contingencies plus the advantages and disadvantages of every. This knowledge normally empower consumers and manufacturers while making told decisions, ensuring its appeal is secure on exchange techniques.

Why should Your Not have a fund Contingency?

When you have zero goal of delivering money in this a specific timeframe, it might not end up being needed to tend to be a loans backup during the the promote. Particularly, if you wish to purchase the complete selling price of your brand-new home with bucks, its not necessary a loans contingency since the absolutely nothing finishes your out of buying the property outright. But not, if you are planning to make use of a vintage financial to invest in new pick, also a financing contingency in your contract is a good idea.

Another reason to help you waive the financing backup was if you find yourself for the a competitive housing market putting in a bid against almost every other potential property owners.

Into the a competitive industries where numerous also provides are required, vendors will favor even offers into the high money number, strongest money conditions, and you may fewest conditions and you will stipulations. And make their promote significantly more aggressive, specific consumers might wish to fill in a non-contingent provide by the waiving its legal rights to all or any version of contingencies, including the assessment backup and you can assessment contingency. Performing this would obviously put you under specific amount of economic chance, and you will probably forfeit people earnest money when it has started paid down to the vendor.

Deja una respuesta