?60,000 Home loan: Monthly Money & Income Standards

Play with our very own one to-of-a-kind mortgage evaluation equipment examine live cost out-of ninety+ loan providers to check out the lowest priced month-to-month payments available to you.

Fool around with the one-of-a-type financial assessment device evaluate alive cost regarding 90+ lenders to discover the least expensive month-to-month repayments on the market.

Costs toward good ?60,000 home loan are very different based the financial type and private factors. Your own mortgage repayments might possibly be dependent on the length of the name, rate of interest, together with brand of home loan you have made.

A lengthier identity results in less monthly costs, but you will pay so much more total. The higher the speed, the greater you are able to pay and when you get an appeal-only financial, such as for example, possible just shelter the attention charge, maybe not the principal amount borrowed.

In this post, we are going to go through the monthly money we provide having a beneficial ?60,000 mortgage, yearly income, in addition to deposit count you will have to get this financial. As well as how using a mortgage broker makes it possible to get the credit you need at the most competitive rates of interest.

In this article:

- Exactly how much can it costs monthly?

- Homeloan payment Calculator

- Exactly how much want to earn?

- How much put do you want?

- How to get good ?60,000 financial

- Monthly costs by-term and you can price

- Points affecting monthly money

- Other will set you back to take on

- Get coordinated towards the correct mortgage broker

During composing (), the common month-to-month costs to your an effective ?60,000 financial are ?351. This will be based on latest interest levels are around 5%, a normal mortgage label of 25 years, and you may opting for a money repayment financial. Predicated on this, might pay off ?105,226 by the end of your home loan name.

However, for those who secure a mortgage with an extended identity, thirty years, such as for example, the quantity you pay straight back would be highest, but your monthly repayments was quicker.

Keep in touch with among the many advisors i manage to track down a harsh concept of everything you are going to repay. They could help you secure favourable terms minimizing costs than just if you attempt in order to safer home financing on your own.

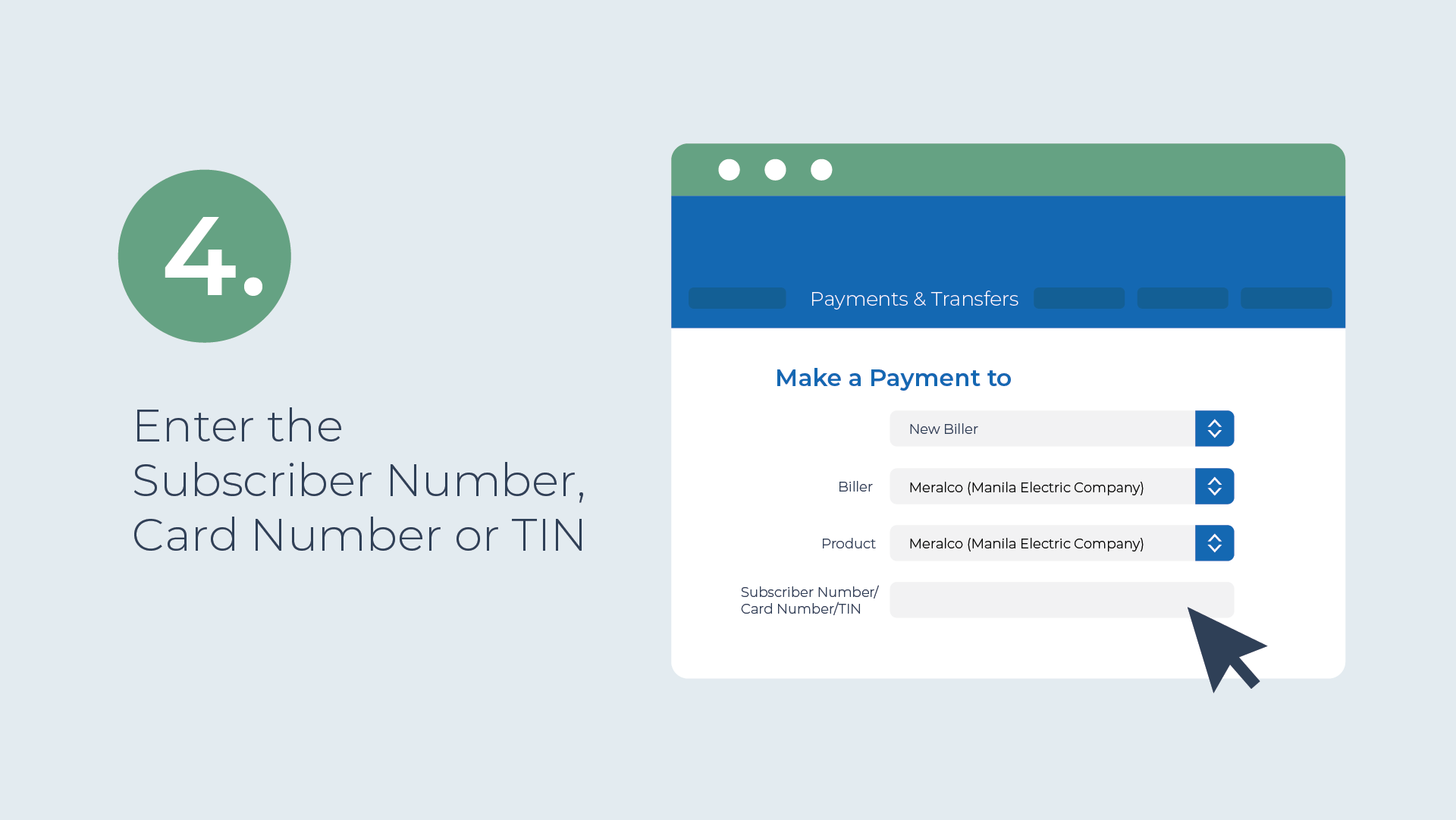

Homeloan payment Calculator

So it calculator can tell you brand new month-to-month and total cost of your home loan, in line with the loan amount, interest, and you can identity length.

The latest monthly costs on a mortgage will be

Start with an expert agent to ascertain just how much they might save on your own home loan repayments.

Just how much want to earn to get a great ?60,000 mortgage?

Generally speaking, the amount you could borrow is dependant on your own paycheck. Extremely lenders have a tendency to loan doing cuatro otherwise 4.five times the yearly income. According to this type of numbers, you’ll you would like a yearly earnings with a minimum of ?15,000 is acknowledged getting a ?60,000 home loan. This is certainly underneath the average British annual paycheck, already ?34,900 ().

Particular loan providers could be willing to bring 5 times or maybe even half dozen moments your own yearly income. Although not, the latest situations in which this could be almost certainly try for folks who already have an enormous put and/or perhaps the house you are looking to purchase try respected at ?100,000 or less.

Because ?60,000 are a relatively short share to own home financing, you’ll likely you need a big deposit as recognized or has certain products, including becoming loans in Cheyenne Wells good retiree seeking to downsize so you can a smaller assets.

Such as, you might think getting a shared home loan having good lover whenever you are not knowing whether or not you can easily meet up with the lender’s qualifications conditions. This will will let you use your shared income to reach the minimum income conditions place by the lenders.

Deja una respuesta