It can be utilized for both ongoing costs and you may new financing

The new Cost Calculator can be used to discover the fees number otherwise amount of costs, like playing cards, mortgage loans, automobile financing, and private fund.

Result

Installment is the work out-of trying to repay currency in earlier times borrowed out of a lender, and you can failure to settle loans can potentially push one to declare bankruptcy and you will/or honestly affect credit score. This new costs regarding individual funds usually are manufactured in occasional repayments that include specific principal and you can interest. Throughout the calculator, there are two main repayment times to pick from: a predetermined loan label or a predetermined fees.

Fixed Mortgage Title

Choose that one to enter a fixed loan title. For-instance, the new calculator are often used to determine whether a good 15-12 months or 29-seasons financial renders a whole lot more experience, a familiar decision a lot of people need to make when purchasing a beneficial home. The newest determined results tend to screen the fresh month-to-month fees necessary to pay off of the financing inside the specified financing label.

Repaired Installments

Like this one to go into a fixed add up to be paid per month until the financing and you may interest was paid-in full. The newest calculated abilities commonly display the borrowed funds title needed to spend from the loan at this monthly repayment. As an example, which ount away from disposable money dependent on subtracting costs off earnings which can be used to invest straight back a credit card equilibrium.

On the You.S., the consumer fund are set to-be repaid monthly. Allow me to share five of the very most preferred money.

Mortgages

Regarding You.S., mortgages are required to become repaid monthly playing with fixed or varying cost, otherwise switched from 1 to the other inside lives of one’s mortgage. To have fixed-rate mortgage loans, the brand new monthly cost number is restricted about financing name. Borrowers can pick to expend so much more (although not faster) compared to the needed repayment matter. So it calculator does not consider changeable rates loans. To find out more, make use of the Home loan Calculator.

Car loan

Particularly mortgages, auto loans should be reduced monthly, always in the repaired rates. Individuals can also choose spend far more (but not quicker) as compared to required installment number. To find out more, make use of the Car loan Calculator.

Student education loans

In the us, government entities has the benefit of official plans which might be tailored specifically for the installment from federal college loans. With respect to the personal debtor, you will find cost agreements which can be earnings-established, arrangements you to offer the word of the mortgage, or plans specifically for moms and dads otherwise graduate children. Repayment of all federal figuratively speaking would be delay to a few part of the future. Government stretched fees preparations will be stretched up to twenty five years, but just remember that , this can bring about more attract given out complete. For more information, use the Student loan Calculator.

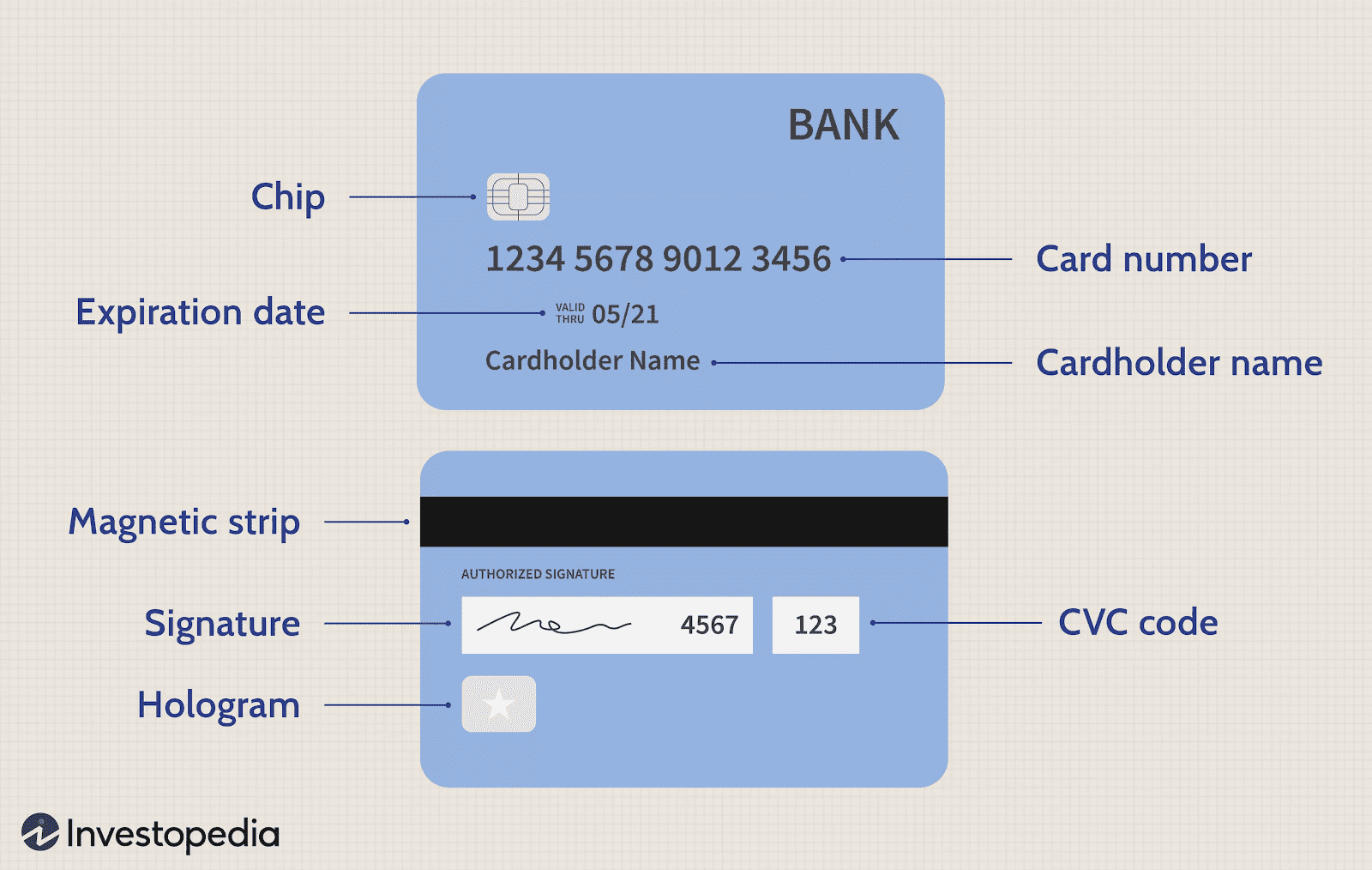

Credit cards

Credit card loans are believed revolving credit. The new installment from handmade cards is different from typically prepared amortized loans. Whereas the latter demands an appartment total be paid a great few days, this new fees regarding rotating borrowing is far more flexible for the reason that new number can vary, even though there are at least commission owed on each credit card every month that must definitely be found to avoid punishment. For more information, use the Bank card Calculator.

Simple tips to Pay back Fund Smaller

If there’s zero prepayment punishment involved, any additional currency supposed on a loan might possibly be used to reduce steadily the principal amount owed. This can automate the time in which the dominating due in the end are at no and you will reduces the amount of attention owed due to the fact of the less dominant matter that is owed.

Having finance that want month-to-month payments, entry half of this new monthly payment every 14 days in place of you to monthly payment can be automate the newest payment off financing within the several indicates. First and foremost, faster full focus have a tendency to accrue given that money commonly lessen the dominating balance more frequently. Secondly, biweekly repayments for a whole 12 months usually equivalent twenty six annual costs since there are 52 weeks in the a year. It is comparable to and also make thirteen monthly payments annually. Before generally making biweekly costs, make certain that there are no prepayment punishment on it.

Mortgage refinancing pertains to taking out fully a new loan, often with increased favorable conditions, to exchange a preexisting financing. Consumers normally refinance the loans so you can smaller conditions to repay the fresh new fund quicker and save money on desire. Yet not, borrowers generally have to pay refinancing fees initial. These charge could be extremely high. Be sure to gauge the positives and negatives before generally making the refinancing decision.

The new methods more than is almost certainly not applicable for all finance. As well as, it is essential to to evaluate if or not settling finance quicker is actually actually wise economically. And come up with most money towards your funds are great, they loans Collinsville AL are certainly not absolutely necessary, there try possibility can cost you you to are entitled to said. For instance, an emergency funds will come from inside the convenient whenever incidents such scientific problems otherwise motor vehicle collisions occurs. Even carries one work well through the a beneficial age become more economically useful than extra costs towards the lowest-desire loan.

Deja una respuesta